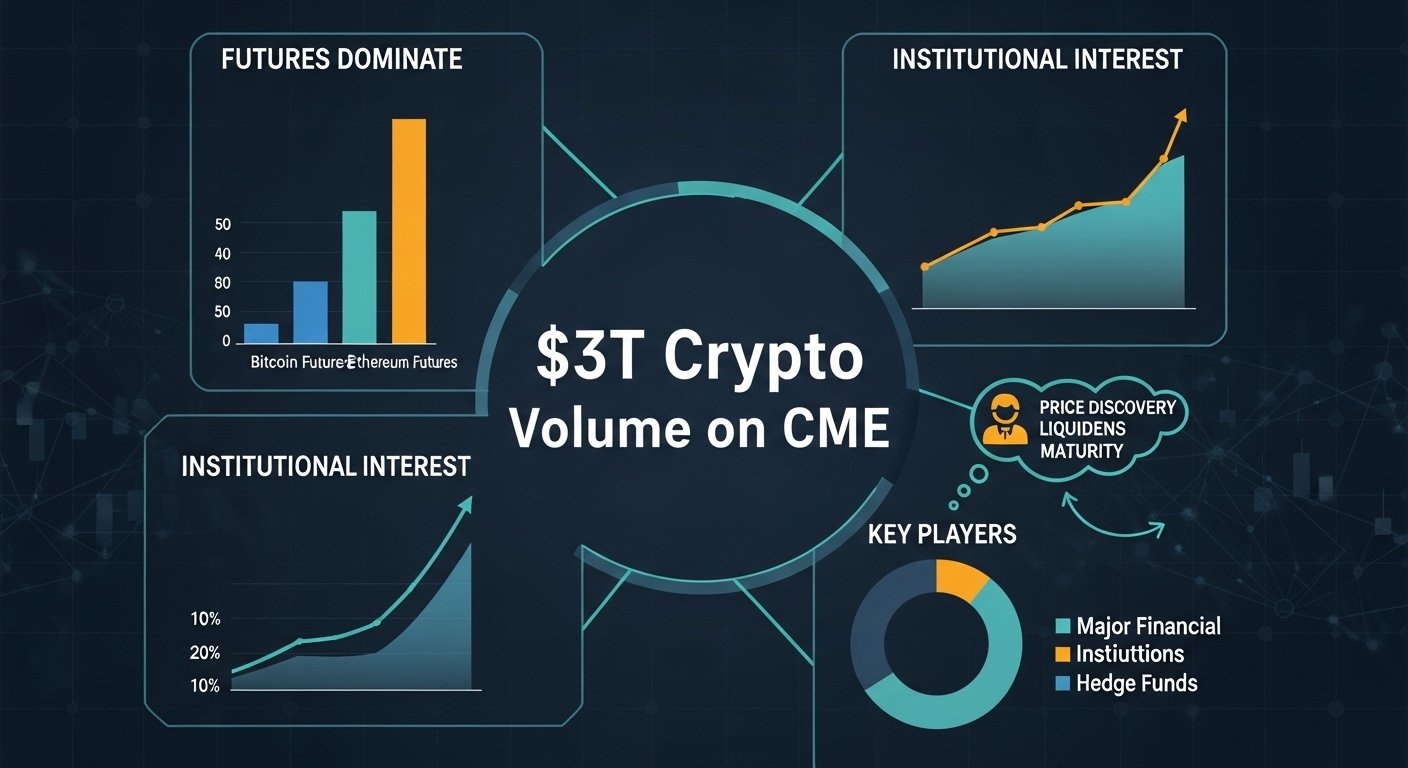

$3T Crypto Volume on CME Institutions Hit Full Throttle

$3T crypto volume surges through CME as institutions ramp exposure. Explore drivers, products, liquidity, risks, and what comes next.

$3T crypto volume is said to be ripping through a regulated titan like the Chicago Mercantile Exchange, it signals something bigger than a retail rally. It suggests the market’s center of gravity is shifting—away from purely offshore venues and toward the infrastructure institutions already trust for commodities, rates, and equity index futures. In other words, crypto is increasingly trading like a grown-up asset class, with risk management, margin discipline, and professional liquidity priorities shaping the flow.

This matters because CME is not just another exchange. It’s a venue where large funds, banks, proprietary trading firms, and corporates can access CME futures under familiar rulebooks. When crypto volume accelerates there, it often reflects a broader institutional cycle: more hedging activity, more relative-value trading, deeper derivatives usage, and more sophisticated positioning around catalysts such as macro data, volatility regimes, or spot market structure changes. It’s also a sign that participants are treating crypto less like a novelty and more like a portfolio component—something that must be sized, hedged, and continuously monitored.

At the same time, big numbers can be misleading without context. A headline like $3T crypto volume can include notional turnover in derivatives, where traders recycle capital quickly. That doesn’t make it “fake”—it’s how futures markets work—but it does mean the story is really about participation, efficiency, and the maturity of the derivatives market, not simply “new dollars entering.” The real signal is that institutions are active, and they’re using a regulated pipeline to express views on Bitcoin and Ethereum, manage exposure, and harvest spreads.

In this article, we’ll unpack what a surge in crypto volume through CME can mean, why institutions “step on the gas,” which strategies and products likely drive the flow, how it impacts liquidity and price discovery, and what risks still sit under the surface. The goal is not hype, but clarity—because when crypto volume moves into institutional lanes, the market’s rhythm changes.

What “$3T Crypto Volume on CME” Really Indicates

When people hear $3T crypto volume, they often picture a tidal wave of fresh buying. In reality, futures volume is a measure of how much notional value changes hands, not a direct count of net inflows. That distinction is critical. In a healthy futures market, the same capital can generate large crypto volume as traders enter and exit positions, roll contracts, arbitrage spreads, and hedge risk in response to price movement.

CME’s growth in crypto volume typically points to three structural developments happening at once. First, more institutions are comfortable holding and trading crypto exposure in a regulated format, using familiar clearing and margin systems. Second, the market has matured enough to support institutional strategies such as cash-and-carry, delta hedging, and volatility trading. Third, the ecosystem around CME products—prime brokerage, execution, analytics, and risk tooling—has become robust enough that large firms can scale activity without reinventing operational processes.

Another key element is transparency. CME futures feed into widely followed benchmarks, and many analysts track CME positioning and open interest as a window into institutional appetite. Rising crypto volume paired with rising open interest often suggests new positioning is building. Rising volume while open interest stays flat can imply faster turnover—more trading, less lasting exposure. Both can be bullish signals for market maturity, but they tell different stories about conviction.

Finally, CME’s reputation matters. Institutions often prefer venues where rules are predictable, credit risk is managed through clearing, and compliance frameworks are straightforward. When crypto volume concentrates there, it can indicate that the most regulated participants are no longer sitting on the sidelines. They’re participating—sometimes aggressively.

Why Institutions Are Stepping on the Gas Now

Institutional accelerations in crypto volume rarely happen for just one reason. They usually occur when multiple incentives align: clearer regulation, better market infrastructure, attractive risk-adjusted opportunities, and client demand. When institutions “step on the gas,” they’re not only chasing upside—they’re responding to an environment where trading and hedging crypto becomes operationally rational.

The Institutional Comfort Factor: Regulated Rails and Familiar Mechanics

Institutions operate under constraints: compliance, counterparty limits, custody rules, and governance. A regulated futures exchange lowers friction. CME contracts sit within established clearing frameworks, enabling systematic hedging, standardized margin requirements, and consolidated risk reporting. For many firms, this is the difference between “we can’t touch it” and “we can allocate a sleeve.”

As a result, a surge in crypto volume on CME often reflects participants who were previously constrained rather than unconvinced. Once the operational hurdle clears, activity can ramp quickly—especially among funds that already run futures-based playbooks in other markets.

Macro Regimes and the Search for Uncorrelated or Convex Exposure

Crypto’s relationship to macro has evolved. In some regimes it trades like a risk asset; in others it behaves like a liquidity barometer; and during stress it can gap sharply. That convexity—large moves in short windows—can be attractive to traders who manage volatility across asset classes. When macro volatility rises or rates expectations shift, institutions may boost crypto volume to reposition quickly using futures, where execution and hedging can be cleaner than spot.

Even when correlations rise, crypto can still offer differentiated opportunities through basis, funding, and options-implied volatility. Institutions often increase crypto volume when those pricing relationships become especially rich or dislocated.

Client Demand and the Professionalization of Crypto Allocation

There’s also a simpler driver: clients ask for it. Wealth platforms, asset managers, and sophisticated allocators increasingly treat crypto exposure as something they want access to—whether as a strategic allocation or a tactical trade. CME’s listed products offer a format that fits institutional mandates. As the “buyer base” professionalizes, crypto volume follows.

How CME Products Channel Institutional Crypto Volume

CME’s crypto lineup is designed for professional risk transfer. Even if a firm ultimately wants spot exposure, futures often become the primary tool for entry, exit, or hedging, because they can be traded efficiently, integrated into existing systems, and managed within established risk frameworks.

Bitcoin and Ethereum Futures as the Core Engine

The backbone of CME’s crypto volume is typically Bitcoin futures and Ethereum futures. These contracts allow institutions to express directional views, hedge spot holdings, and implement relative-value strategies. Futures are also attractive for firms that prefer not to handle spot custody directly. When crypto volume spikes, it often reflects both directional speculation and hedging demand around volatility events.

Another subtle point is that futures can concentrate liquidity. In many markets, the most liquid “price discovery” happens in derivatives. When CME sees rising crypto volume, it can become a stronger reference point for institutional price formation, especially during U.S. trading hours.

Micro Contracts and Access for Smaller Institutional Tickets

Micro-sized contracts can meaningfully expand participation. Not every institution trades in massive clips; some prefer granular position sizing, especially for portfolio overlays or smaller mandates. By enabling more precise risk adjustments, micro contracts can contribute to higher crypto volume through increased trade frequency and broader adoption.

Clearing, Margin, and the Institutional Operating System

The clearinghouse is not glamorous, but it’s foundational. Institutional trading lives and dies by collateral efficiency. Futures with clear margin rules and centralized clearing can be easier to scale than bilateral exposure. In periods where volatility rises, margin requirements adjust, and institutions often respond by trading more actively—both to reduce risk and to capture volatility-driven opportunities. That dynamic can amplify crypto volume during fast markets.

The Strategies That Typically Drive CME Crypto Volume

When institutions step on the gas, they rarely do it with a single “buy and pray” approach. They deploy repeatable frameworks designed to monetize spreads, manage risk, and capture statistical edges. These strategies can generate substantial crypto volume even if net exposure doesn’t change dramatically.

Basis and the Cash-and-Carry Trade

One of the most common institutional strategies is cash-and-carry, where a trader buys spot (or a spot proxy) and sells futures when the futures trade at a premium. The goal is to capture the “basis,” the difference between futures and spot prices. When basis is attractive, institutions scale this trade aggressively, which can boost crypto volume on futures venues while also increasing spot demand.

This strategy tends to expand in bullish regimes, when futures premiums widen due to leverage demand. It can also unwind quickly when risk appetite falls, creating bursts of crypto volume during de-leveraging.

Hedging Spot, ETFs, and Structured Exposure

Institutions that hold spot exposure—directly or through structured products—often hedge using futures. If a portfolio manager wants to reduce risk temporarily without selling underlying exposure, they may short futures. Conversely, if they need fast exposure while waiting for spot execution, they may buy futures first. Both behaviors can elevate crypto volume during rebalancing windows.

Relative Value Between Bitcoin and Ethereum

Cross-asset relative-value trading is another contributor. Firms may trade BTC vs. ETH spreads using futures, adjusting risk based on volatility and correlation. These strategies can be high turnover, contributing meaningfully to crypto volume without necessarily implying broad market bullishness or bearishness.

Volatility-Driven Trading and Fast Risk Recycling

In volatile markets, traders recycle risk quickly. Entries, exits, stop-outs, and re-entries can multiply notional turnover. That’s why crypto volume often spikes during major price swings. For institutions, futures provide a fast, standardized instrument to trade volatility, adjust delta exposure, and keep operational risk contained.

Market Impact: Liquidity, Price Discovery, and Volatility

As CME absorbs more crypto volume, the market can change in ways that are subtle but powerful. Liquidity can deepen in some areas while becoming more fragmented in others. Price discovery can shift toward derivatives. Volatility can become more “macro-like,” with event-driven bursts and cross-asset linkages.

Liquidity Quality Improves, But Fragmentation Increases

Institutional liquidity is often higher quality: tighter spreads, deeper order books, and more consistent quoting—especially during core trading hours. More crypto volume on CME can improve overall market functioning by encouraging professional market-making and arbitrage that keeps prices aligned.

However, fragmentation can rise too. If liquidity clusters differently across spot venues, offshore derivatives, and CME futures, spreads between markets can widen temporarily during stress. Arbitrageurs usually compress these gaps, but in fast conditions, dislocations can appear.

Stronger Price Discovery Through a Regulated Derivatives Lens

When crypto volume shifts toward CME, the market may increasingly reference futures prices for directional signals. This can change how traders interpret breakouts, support levels, and trend confirmation. It also affects how broader finance interprets crypto, because futures prices integrate into institutional analytics systems that already monitor rates, equities, and commodities.

Volatility Can Become More “Structured”

As institutions participate more, volatility can develop patterns seen in other futures markets: predictable positioning around macro events, monthly roll dynamics, and systematic strategy behaviors. That doesn’t mean volatility disappears—crypto can still move violently—but the drivers can become more legible. In other words, crypto volume on CME can make parts of the market feel more structured even as the asset remains inherently volatile.

Risks and Caveats Behind the Volume Surge Crypto

A jump in crypto volume is not automatically a “bull market confirmation.” It can also reflect hedging demand, short activity, or leverage unwinds. And even with institutional growth, crypto retains unique risks: regulatory uncertainty, operational hazards, and rapid regime shifts.

Volume Is Not the Same as Net Inflows

This is the most important caveat. $3T crypto volume could include rapid churn by trading firms and arbitrage desks. It may reflect two-sided flow rather than one-directional buying. To interpret it properly, observers also look at open interest, term structure, and how basis behaves through the move.

Leverage and Liquidation Dynamics Still Matter

Futures markets can magnify moves when leveraged positioning becomes crowded. If too many participants lean the same way, a reversal can trigger forced de-risking. That can create surging crypto volume during selloffs as positions unwind. Institutional presence doesn’t remove this risk—it can sometimes accelerate the speed at which repositioning occurs.

Regulatory and Compliance Shifts Can Change Participation Quickly

Institutions are sensitive to regulatory clarity. If rules shift, reporting burdens change, or capital treatment evolves, participation can increase or decrease quickly. A surge in crypto volume on regulated venues is often a vote of confidence in the current environment—but that environment can change.

What to Watch Next If Institutions Keep Accelerating

If institutional crypto volume continues rising through CME, the market will likely keep evolving toward deeper derivatives usage and more interconnected price action with traditional macro assets. The signals to monitor are less about headlines and more about the structure under the hood.

Open Interest, Term Structure, and Basis Health

Watch whether rising crypto volume is accompanied by rising open interest. That can signal new positioning rather than simple churn. Term structure matters too: are futures in contango with a stable premium, or is the curve flattening and inverting? Basis behavior can reveal whether leverage demand is increasing, and whether arbitrage is stepping in efficiently.

Hours of Dominance and the “Institutional Clock”

CME activity can shape intraday patterns. If more crypto volume concentrates during U.S. hours, volatility and trend formation may increasingly occur in those windows. That has implications for global traders and spot venues that historically dominated overnight.

Product Expansion and Cross-Margin Efficiency

If the ecosystem expands—more contract types, deeper liquidity, improved cross-margining with correlated instruments—institutions may scale further. The easier it is to manage collateral and risk centrally, the more likely crypto volume continues shifting toward regulated derivatives infrastructure.

Conclusion

A headline like “$3T crypto volume rips through CME” isn’t just about a big number—it’s about a market maturing in public. It suggests institutions are not merely watching crypto; they’re trading it, hedging it, arbitraging it, and integrating it into the same machinery they use for every major asset class. CME’s role as a regulated derivatives market hub makes it a natural destination for that activity, especially as firms seek standardized contracts, reliable clearing, and robust risk controls.

Still, crypto volume is a lens, not a verdict. It can signal bullish participation, hedging intensity, or leveraged churn depending on how it interacts with open interest, basis, and volatility. The more useful takeaway is structural: institutional participation tends to make markets deeper and more efficient, while also introducing new kinds of regime behavior—roll dynamics, basis cycles, and macro-sensitive positioning.

If institutions keep stepping on the gas, crypto’s next chapter may look less like the wild west and more like a high-speed financial highway—still volatile, still opportunistic, but increasingly shaped by professional capital, regulated rails, and sophisticated risk management.

FAQs

Q: Does $3T crypto volume mean $3T of new money entered crypto?

Not necessarily. Crypto volume measures turnover—how much notional value traded—especially in futures where positions can be opened and closed rapidly. It can be driven by hedging, arbitrage, and short-term trading as much as by net inflows.

Q: Why do institutions prefer CME for crypto trading?

Institutions often prefer CME because it’s a regulated exchange with centralized clearing, standardized contracts, and familiar margin and risk systems. This makes compliance, reporting, and operational scaling easier than on many alternative venues.

Q: What are the main CME products behind institutional crypto volume?

The largest drivers are typically Bitcoin futures and Ethereum futures, alongside smaller-sized contracts that support precise sizing. These products enable hedging, directional exposure, and relative-value strategies that can generate significant crypto volume.

Q: Can rising CME crypto volume affect spot prices?

Yes. Futures activity influences price discovery and can affect spot through arbitrage. If futures premiums widen, strategies like cash-and-carry can increase spot buying while selling futures, linking the two markets tightly.

Q: What indicators help interpret whether rising crypto volume is bullish?

Look beyond crypto volume alone. Pair it with open interest, basis/term structure, and volatility behavior. Rising volume with rising open interest can suggest new positioning, while rising volume with flat open interest may indicate churn or hedging rather than directional conviction.

Also More: Top Crypto Losers Worldcoin, Chiliz, Hyperliquid Crash