7 Top Altcoin Picks APEMARS Leads the Pack

7 top altcoin picks with APEMARS in the lead. Learn use cases, market drivers, and risk factors in one engaging guide.

Crypto market rarely moves in straight lines, and that’s exactly why altcoin picks matter so much to investors, builders, and curious newcomers. When Bitcoin sets the tempo, altcoins often provide the melody—sometimes calm, sometimes chaotic, often full of opportunity. But in a crowded market of thousands of tokens, “what to watch” becomes more valuable than “what to chase.” This is where a curated list of altcoin picks can help you focus on narratives with traction, communities with energy, and projects with a clearer reason to exist beyond hype.

In this guide, we’re breaking down 7 top altcoin picks with a specific spotlight on APEMARS, a project gaining attention for its branding, momentum, and community-driven positioning. Alongside APEMARS, you’ll find six other altcoin picks that represent different pillars of the broader crypto economy—smart contracts, scaling, DeFi infrastructure, interoperability, and developer ecosystems. The goal isn’t to promise guaranteed returns (nothing can), but to explain why each of these altcoin picks stays on the radar, what catalysts could matter next, and what risks you should understand before getting involved.

You’ll also see LSI keywords and related phrases woven naturally through the article, such as crypto market trends, blockchain utility, Web3 ecosystem, tokenomics, market volatility, and risk management. If you’re looking for a human-readable, search-friendly deep dive into altcoin picks—without empty buzzwords—this is built for you.

Before we begin: this content is educational and informational, not financial advice. Crypto assets are volatile, and even the best altcoin picks can drop sharply in uncertain conditions.

Why Altcoin Picks Matter in a Fast-Moving Market

In crypto, attention is liquidity. The projects that capture mindshare tend to attract developers, partnerships, integrations, and—sometimes—speculative capital. That’s why altcoin picks aren’t just about price charts; they’re about understanding where the market’s narrative is flowing.

Strong altcoin picks usually share a few traits: a clear value proposition, visible adoption or community strength, and a roadmap that matches real market demand. Even meme-driven coins can qualify as altcoin picks when they consistently build culture and sustain engagement, because culture itself can be an economic layer in Web3.

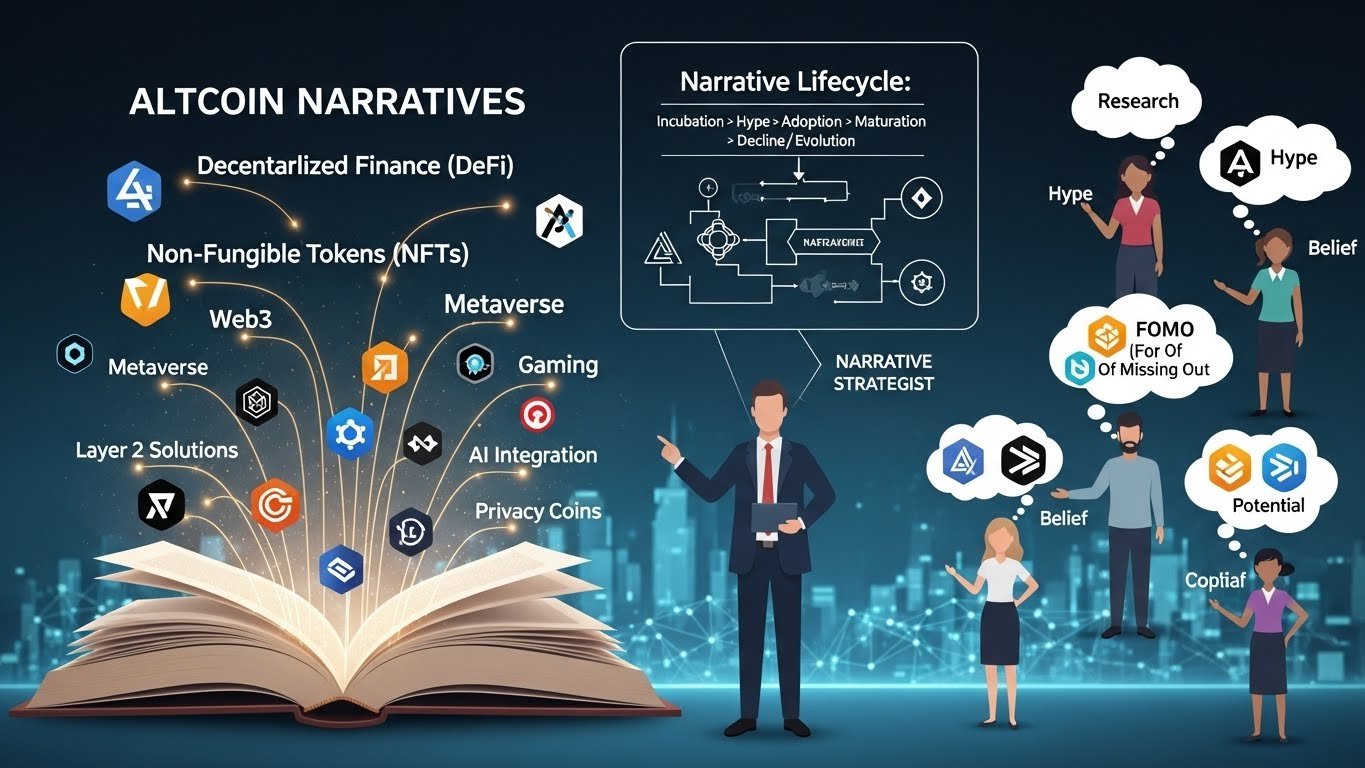

The Role of Narratives in Altcoin Picks

Narratives are the stories investors tell themselves about why something should rise. One cycle is about Layer-2 scaling, another is about AI tokens, another about DeFi yield, and another about community-led memecoins. Smart altcoin picks sit at the intersection of narrative and utility—projects that can ride attention while also shipping meaningful progress.

Volatility, Timing, and Risk Management

Even the best altcoin picks can be punished by macro conditions, regulatory headlines, exchange liquidity shifts, or sudden sentiment reversals. That’s why risk management matters as much as selection. Think in probabilities, not certainty, and consider time horizons. Short-term traders and long-term builders often look at the same altcoin picks and reach completely different conclusions—and both can be rational.

What Makes These 7 Top Altcoin Picks Stand Out

This list of altcoin picks is built around diversity of function. Instead of clustering everything into one narrative, it covers multiple parts of the Web3 ecosystem: infrastructure, scaling, developer tooling, and community-led momentum.

Selection Factors Used for These Altcoin Picks

A good set of altcoin picks should not rely on one metric. Popularity alone can fade, and tech alone can struggle without users. Here, the emphasis is on a blend of:

Market relevance within current crypto market trends, active community presence, ecosystem momentum, and recognizable utility or positioning. Importantly, each of these altcoin picks has a “reason to be watched,” even if your strategy differs from someone else’s.

APEMARS: The Lead Altcoin Pick to Watch Closely

APEMARS takes the lead in this set of altcoin picks because it represents a powerful combination in crypto: branding plus community plus a story that’s easy to share. In a market where attention spreads at the speed of memes, projects that understand identity can travel further than projects that only speak to engineers.

APEMARS, as a leading entry among these altcoin picks, stands out for how it positions itself within internet culture while still aiming to be more than a short-lived trend. Whether you view it as a community token, a culture coin, or a speculative asset tied to social momentum, the underlying reality is the same: community coordination is a force in crypto, and APEMARS leans into that dynamic.

APEMARS Utility, Community Energy, and Token Narrative

Many successful altcoin picks succeed because they reduce friction: friction in understanding, friction in participation, friction in belonging. APEMARS benefits from a theme that’s instantly recognizable and easy to rally around. That matters because tokens are not just assets; they are social objects. People hold them, talk about them, argue about them, and promote them. That social layer can become a distribution channel.

From a tokenomics perspective, what you want to watch with APEMARS is how supply, incentives, and community initiatives align over time. Community coins often rise quickly and fall quickly, but the ones that endure tend to create repeat engagement: campaigns, partnerships, real product hooks, or recurring reasons for the community to show up beyond price.

Key Risks to Understand Before Choosing APEMARS

Because APEMARS leads this list of altcoin picks, it’s worth being extra honest about what could go wrong. The main risk is that attention can rotate. If the narrative moves on and the project doesn’t build sticky value, liquidity can thin out. Another risk is concentration of holdings, which can amplify market volatility if large holders sell.

If you’re considering APEMARS among your altcoin picks, look for signals of sustainability: transparent updates, consistent community growth, credible integrations, and an ecosystem story that keeps evolving. In the culture-coin category, momentum is real—but so is the speed of reversals.

Ethereum: The Blue-Chip Foundation Among Altcoin Picks

Ethereum remains one of the most important altcoin picks because it functions like base infrastructure for Web3. It’s not just a token; it’s a settlement layer that hosts thousands of applications across DeFi, NFTs, on-chain identity, and tokenized assets.

Ethereum’s relevance to altcoin picks is also structural: many other projects are built to scale Ethereum, connect to Ethereum, or compete with Ethereum. In that sense, it’s a hub asset that influences how multiple narratives evolve.

Why Ethereum Still Anchors Serious Altcoin Picks

For long-term participants, Ethereum is often a “core” holding because of its developer network, tooling maturity, and consistent role in the blockchain utility conversation. Even when new chains rise, Ethereum remains central to liquidity and protocol experimentation.

What to Monitor Next

When evaluating Ethereum as one of your altcoin picks, watch network upgrades, fee dynamics, Layer-2 adoption, and real-world asset experimentation. Ethereum’s story isn’t about quick flips; it’s about the long game of becoming a global coordination layer.

Solana: Speed, UX, and the Retail Wave of Altcoin Picks

Solana has become a major name among altcoin picks because it emphasizes speed and user experience. In crypto, UX can be destiny. When transactions are cheap and apps feel responsive, usage tends to rise.

Solana’s position among altcoin picks also reflects developer momentum and growing consumer-facing applications. While every chain has tradeoffs, Solana’s appeal is straightforward: it aims to make crypto apps feel less like clunky prototypes and more like modern products.

Solana’s Ecosystem as a Growth Engine

The more builders build, the more users arrive; the more users arrive, the more builders build. That loop can strengthen an asset’s role among altcoin picks—especially when consumer adoption is a key theme.

Risk Factors to Keep in View

Every chain faces technical and market risks, including congestion issues, security concerns, and narrative competition. For Solana, evaluating it as one of your altcoin picks means tracking network resilience and the diversity of real usage beyond speculation.

Chainlink: The Data Backbone in Many Altcoin Picks

Chainlink often appears in thoughtful altcoin picks lists because it provides a critical piece of infrastructure: reliable data delivery to smart contracts. Oracles may not sound exciting, but they’re essential for DeFi, derivatives, stablecoins, and many cross-chain designs.

When people talk about crypto market trends moving toward more sophisticated on-chain finance, Chainlink’s role becomes even more relevant. It’s not just a token narrative—it’s an infrastructure narrative.

Why Oracles Matter for Blockchain Utility

Smart contracts can’t safely reference off-chain data without an oracle mechanism. That’s where Chainlink fits, making it one of the more “plumbing-level” altcoin picks that still benefits from ecosystem growth.

What Makes Chainlink Unique in Altcoin Picks

The long-term angle for Chainlink as one of your altcoin picks is continued integration and adoption across protocols. The more protocols rely on its services, the stronger its network effect can become.

Polygon: A Scaling Story That Still Fits Altcoin Picks

Polygon remains a notable name among altcoin picks because scaling remains one of the core challenges in crypto. Even with multiple Layer-2 options, Polygon has built brand recognition, partnerships, and an active builder environment.

Polygon’s place among altcoin picks is often tied to its attempts to stay relevant through evolving scaling approaches, developer support, and ecosystem collaborations.

Polygon’s Relevance to Web3 Ecosystem Growth

For many mainstream brands and Web3 experiments, Polygon has been a familiar gateway. That matters when you’re thinking about adoption beyond crypto-native users, because familiarity can reduce friction.

The Competitive Reality of Scaling

Scaling is crowded. For Polygon as one of your altcoin picks, the key is tracking differentiation: technical roadmap, adoption metrics, and how well the ecosystem attracts builders compared to alternatives.

Arbitrum: Layer-2 Momentum and the Future of Altcoin Picks

Arbitrum stands out among altcoin picks because Layer-2 scaling is not a side story anymore; it’s a central story. As Ethereum usage grows, Layer-2 networks that improve cost and speed can capture real activity.

Arbitrum’s ecosystem relevance, DeFi presence, and developer momentum make it a frequent inclusion in altcoin picks that lean toward infrastructure rather than pure hype.

Why Layer-2 Networks Change the Altcoin Picks Landscape

Layer-2 networks can become their own mini-economies: apps, liquidity, communities, governance, and incentives. That means altcoin picks in this space are partly about ecosystem competitiveness and partly about user experience.

The Main Risks

Layer-2 competition is fierce, and incentives can shift behavior. If you include Arbitrum among your altcoin picks, track real user retention and sustainable activity—not just temporary liquidity mining spikes.

Avalanche: Modular Expansion and Another Strong Altcoin Pick

Avalanche is often included in altcoin picks because it offers a flexible architecture and an ecosystem that has repeatedly tried to expand into new verticals. Whether you’re focused on DeFi, subnets, or institutional experimentation, Avalanche has positioned itself as a platform aiming for customization.

As altcoin picks go, Avalanche sits in the category of “serious platform assets” that can benefit from adoption, partnerships, and continued developer growth.

Avalanche’s Place in Crypto Market Trends

When markets move from pure speculation toward utility, platforms that support varied applications can thrive. Avalanche’s approach has appealed to teams that want a tailored environment.

What to Watch Going Forward

For Avalanche as one of your altcoin picks, watch developer activity, ecosystem funding, and whether new applications create long-term users. The strongest signal is always usage that persists through market cycles.

How to Think About Altcoin Picks Without Over-Optimizing Your Strategy

Even with a strong list of altcoin picks, your approach should match your goals. A trader might focus on momentum and liquidity. A long-term investor might focus on adoption and developer growth. A community participant might focus on culture and engagement.

Balancing High-Conviction and High-Volatility Altcoin Picks

APEMARS represents the higher-volatility, culture-driven side of altcoin picks, while assets like Ethereum represent the more established infrastructure side. Many portfolios blend both styles, but the blend depends on risk tolerance and time horizon.

The Importance of Position Sizing and Patience

In crypto, being “right” can still lose money if timing and sizing are wrong. Thoughtful altcoin picks paired with disciplined risk management often outperform chaotic decision-making over time.

Conclusion

These altcoin picks are not a guarantee of profits; they’re a structured way to focus your attention. APEMARS takes the lead in this list because it’s capturing community energy and narrative momentum, which can be powerful forces in crypto. At the same time, infrastructure-focused altcoin picks like Ethereum, Solana, Chainlink, Polygon, Arbitrum, and Avalanche represent different ways the broader Web3 economy keeps building—sometimes quietly, sometimes loudly, often both.

If you want to use altcoin picks effectively, stay curious, track real signals (activity, adoption, developer momentum), and respect volatility. In crypto, the best edge is not predicting perfectly; it’s preparing consistently.

FAQs

Q: What are altcoin picks, and why do they matter?

Altcoin picks are selected cryptocurrencies beyond Bitcoin that are chosen for their potential narrative strength, ecosystem growth, or utility. They matter because altcoins often move faster than Bitcoin and can reflect emerging crypto market trends.

Q: Why is APEMARS leading these altcoin picks?

APEMARS leads these altcoin picks because community-driven momentum can be a major market driver. Strong branding and social coordination can create powerful demand cycles, especially when engagement stays consistent.

Q: Are Ethereum and Solana still good altcoin picks for beginners?

Many people consider Ethereum and Solana approachable altcoin picks because they have large ecosystems and broad tooling support. However, beginners should still consider volatility and learn basic risk management.

Q: How do I evaluate altcoin picks beyond price?

Look at blockchain utility, active users, developer activity, ecosystem partnerships, product adoption, and transparency in updates. Healthy communities and clear roadmaps often matter more than short-term charts.

Q: What’s the biggest risk with altcoin picks?

The biggest risk is volatility and narrative rotation. Even strong altcoin picks can drop sharply if liquidity dries up, sentiment shifts, or broader market conditions deteriorate. Diversification and position sizing can help manage that risk.