Bitcoin Market News Today Analysis Trends & Predictions 2025

Get comprehensive bitcoin market news today analysis with real-time price updates, expert predictions, and actionable trading insights...

The cryptocurrency landscape continues to evolve at a breathtaking pace, making bitcoin market news today analysis more critical than ever for investors and traders worldwide. As Bitcoin maintains its position as the flagship digital asset, understanding current market dynamics, price movements, and emerging trends has become essential for making informed investment decisions. This comprehensive bitcoin market news today analysis delivers real-time insights into price action, regulatory developments, institutional adoption patterns, and technical indicators that shape the market. Whether you’re a seasoned trader or new to cryptocurrency investing, staying updated with accurate bitcoin market news today analysis helps you navigate the volatile waters of digital asset markets with confidence and strategic clarity.

Current Bitcoin Price Action and Market Performance

Real-Time BTC Price Movement Analysis

The Bitcoin market has demonstrated remarkable resilience throughout recent trading sessions, with price action reflecting a complex interplay of macroeconomic factors and crypto-specific catalysts. Today’s BTC market update reveals significant trading volume across major exchanges, indicating robust market participation from both retail and institutional investors. The current bitcoin price analysis shows consolidation patterns that technical analysts interpret as potential accumulation zones, suggesting that savvy investors are positioning themselves for the next major price movement.

Market participants are closely monitoring key support and resistance levels that have historically served as critical decision points for Bitcoin’s trajectory. The cryptocurrency market trends indicate that Bitcoin continues to dominate market capitalization, maintaining approximately 50-55% of the total crypto market value. This dominance metric serves as a barometer for overall market health and investor confidence in digital assets.

Volume Analysis and Trading Patterns

Trading volume remains a crucial indicator in any comprehensive bitcoin trading analysis. Recent data shows increased participation during specific market hours, particularly during the overlap of Asian and European trading sessions. This volume distribution suggests global investor interest remains strong, with institutional investors contributing significantly to daily trading volumes through over-the-counter desks and regulated exchanges.

The digital currency market has witnessed substantial inflows into Bitcoin-related investment products, including spot ETFs and futures contracts. These instruments have democratized access to Bitcoin exposure, allowing traditional investors to participate without directly holding the underlying asset. This development represents a paradigm shift in how mainstream finance interacts with cryptocurrency markets.

Technical Analysis: Key Indicators and Chart Patterns

Moving Averages and Trend Indicators

Professional traders conducting bitcoin market news today analysis consistently reference moving averages to identify trend direction and potential reversal points. The 50-day and 200-day moving averages serve as critical benchmarks for determining whether Bitcoin maintains a bullish or bearish market structure. When the price trades above these key moving averages, technical analysts interpret this as confirmation of bullish momentum.

The Relative Strength Index (RSI) provides additional context for market conditions, helping traders identify overbought or oversold scenarios. Combined with the Moving Average Convergence Divergence (MACD) indicator, these tools form the foundation of comprehensive Bitcoin technical analysis that informed traders use to time their market entries and exits.

Support and Resistance Levels

Identifying key support and resistance zones remains fundamental to effective bitcoin price analysis. Historical price levels where Bitcoin has previously experienced significant buying or selling pressure often act as psychological barriers that influence future price action. Professional analysts mark these zones on their charts to anticipate potential price reactions and plan their trading strategies accordingly.

Fibonacci retracement levels offer another layer of technical insight, helping traders identify potential reversal zones during corrections or rallies. These mathematical ratios, derived from the Fibonacci sequence, have proven remarkably accurate in predicting where Bitcoin might find support during pullbacks or encounter resistance during advances.

Fundamental Factors Driving Bitcoin Markets

Institutional Adoption and Corporate Treasury Strategy

One of the most significant developments in recent bitcoin market news today analysis involves the continued institutional adoption of Bitcoin as a treasury reserve asset. Major corporations have added Bitcoin to their balance sheets, viewing it as a hedge against inflation and currency devaluation. This trend represents a fundamental shift in how traditional businesses perceive cryptocurrency as a legitimate store of value.

The institutional Bitcoin adoption narrative has strengthened considerably, with pension funds, endowments, and family offices allocating portions of their portfolios to digital assets. This institutional capital influx provides substantial support for Bitcoin’s long-term valuation and reduces overall market volatility as these entities typically invest with longer time horizons than retail traders.

Regulatory Developments and Policy Impact

Regulatory clarity continues to shape cryptocurrency market trends in profound ways. Recent developments in major economic jurisdictions have provided greater certainty for market participants, encouraging both institutional and retail investment. The approval of Bitcoin spot ETFs in the United States marked a watershed moment, legitimizing Bitcoin in the eyes of traditional financial institutions and opening access to millions of potential investors through familiar investment vehicles.

Global regulatory frameworks are evolving to accommodate digital assets while protecting investors and maintaining financial system integrity. Countries implementing clear, balanced regulations tend to attract blockchain innovation and cryptocurrency businesses, creating positive feedback loops that support market development and price appreciation.

Market Sentiment Analysis and Investor Behavior

Fear and Greed Index Insights

The crypto market sentiment gauge, commonly known as the Fear and Greed Index, provides valuable insight into prevailing investor psychology. This composite indicator analyzes multiple factors including volatility, market momentum, social media activity, and trading volumes to determine whether fear or greed dominates market decision-making. Extreme fear often presents buying opportunities for contrarian investors, while extreme greed may signal overheated conditions warranting caution.

Understanding market psychology enhances bitcoin trading analysis by helping investors recognize when emotional decision-making might be overwhelming rational analysis. Successful traders often move counter to prevailing sentiment, accumulating positions when others panic and exercising caution when euphoria dominates market discourse.

Social Media and News Impact

In today’s interconnected world, social media platforms significantly influence short-term Bitcoin price prediction and market movements. Major announcements from influential figures, viral content, and trending discussions can trigger rapid price swings as millions of retail investors react simultaneously. Savvy market participants monitor social sentiment alongside traditional metrics to gain a comprehensive view of market dynamics.

News cycles dramatically impact cryptocurrency volatility, with major announcements regarding regulation, institutional adoption, or technological developments often catalyzing significant price movements. Traders conducting thorough bitcoin market news today analysis maintain awareness of scheduled events like Federal Reserve meetings, inflation reports, and cryptocurrency-specific developments that might influence market sentiment.

Bitcoin ETF Market Dynamics

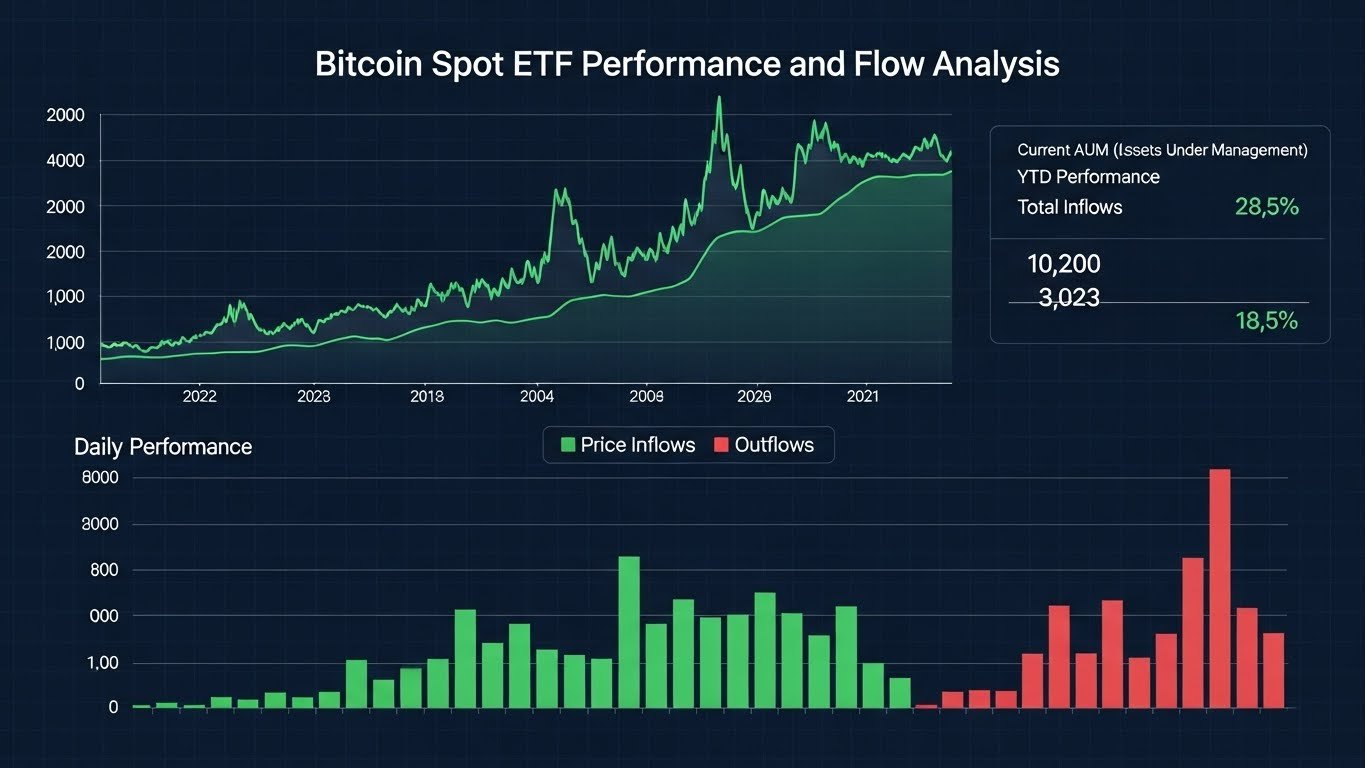

Bitcoin Spot ETF Performance and Flow Analysis

The introduction of Bitcoin spot ETFs revolutionized access to cryptocurrency markets for traditional investors. Bitcoin ETF news consistently ranks among the most searched topics as investors track fund flows, performance metrics, and adoption rates. These investment vehicles have attracted billions in assets under management, providing substantial and relatively stable demand for Bitcoin.

Daily flow data from Bitcoin ETFs offers insight into institutional sentiment and capital allocation trends. Consistent inflows suggest growing confidence and mainstream acceptance, while outflows might signal profit-taking or risk-off sentiment. Professional analysts incorporate ETF flow analysis into comprehensive bitcoin market news today analysis to gauge institutional positioning.

Impact on Price Discovery and Market Structure

Bitcoin ETFs have fundamentally altered market structure by creating new price discovery mechanisms and increasing overall market efficiency. The presence of large, regulated investment vehicles trading Bitcoin exposure on traditional stock exchanges has reduced arbitrage opportunities and tightened bid-ask spreads across cryptocurrency exchanges globally.

This market evolution benefits all participants through improved liquidity and more accurate price discovery. The integration of cryptocurrency markets with traditional finance represents a maturation process that should continue supporting Bitcoin’s legitimacy as an investable asset class.

Macroeconomic Factors Influencing Bitcoin

Inflation, Interest Rates, and Monetary Policy

Macroeconomic conditions play a crucial role in shaping cryptocurrency market trends and Bitcoin’s value proposition. Bitcoin was created in response to the 2008 financial crisis, with its limited supply of 21 million coins designed as a hedge against monetary inflation. As central banks worldwide navigate inflation management through interest rate adjustments, Bitcoin’s performance often reflects investor concerns about currency devaluation and purchasing power erosion.

Higher interest rates typically strengthen traditional currencies and offer attractive yields on bonds, potentially reducing appetite for non-yielding assets like Bitcoin. Conversely, when real interest rates (adjusted for inflation) remain negative, Bitcoin’s scarcity and inflation-resistant properties become more attractive, often supporting price appreciation.

Global Economic Uncertainty and Safe Haven Demand

During periods of geopolitical tension or financial market stress, some investors turn to Bitcoin as a portfolio diversifier or alternative store of value. While Bitcoin’s volatility exceeds that of traditional safe haven assets like gold or government bonds, its decentralized nature and limited supply appeal to those seeking assets outside the traditional financial system.

The digital currency market has matured considerably, with Bitcoin demonstrating increasing correlation with traditional risk assets during certain periods while maintaining unique characteristics that justify its inclusion in diversified portfolios. Sophisticated investors conduct regular bitcoin price analysis to determine optimal allocation sizes based on their risk tolerance and investment objectives.

Mining Industry Updates and Hash Rate Analysis

Network Security and Mining Economics

The Bitcoin mining industry provides critical infrastructure securing the network through computational power. Hash rate, which measures the total computing power dedicated to mining Bitcoin, serves as a proxy for network security and miner confidence. Rising hash rates indicate that miners find Bitcoin mining profitable and are investing in additional capacity, suggesting bullish long-term outlook from those most intimately familiar with the ecosystem.

Mining economics depend on Bitcoin’s price, mining difficulty, energy costs, and hardware efficiency. Professional bitcoin market news today analysis incorporates mining profitability metrics because miners represent significant sellers who must periodically liquidate Bitcoin to cover operational expenses. Understanding miner behavior helps predict potential selling pressure and market dynamics.

Environmental Sustainability and Energy Transition

The Bitcoin mining industry has made substantial progress toward environmental sustainability, with increasing percentages of hash rate powered by renewable energy sources. This transition addresses longstanding criticisms about Bitcoin’s energy consumption and positions the network more favorably for institutional adoption by ESG-conscious investors.

Innovations in mining technology, including more efficient hardware and methane capture projects that use otherwise-wasted energy, demonstrate the industry’s commitment to sustainability. These developments feature prominently in contemporary bitcoin trading analysis as environmental considerations increasingly influence investment decisions.

Altcoin Market Correlation and Bitcoin Dominance

Understanding Market Interdependencies

Bitcoin’s performance significantly influences the broader cryptocurrency market trends, with altcoins often following Bitcoin’s directional movements with amplified volatility. Bitcoin dominance, measuring Bitcoin’s market cap as a percentage of total cryptocurrency market capitalization, helps traders understand whether capital is flowing into or out of alternative cryptocurrencies.

When Bitcoin dominance increases, it typically indicates that investors are consolidating positions into the market leader, often during uncertain market conditions. Declining dominance may signal “altseason,” periods when traders rotate capital into higher-risk, potentially higher-reward alternative cryptocurrencies seeking outsized returns.

Portfolio Diversification Strategies

Sophisticated crypto investors maintain diversified portfolios that balance Bitcoin’s relative stability with altcoins’ growth potential. Effective crypto investment strategy considers correlation patterns, risk-adjusted returns, and individual project fundamentals when allocating capital across different cryptocurrencies.

Bitcoin typically serves as the core holding in cryptocurrency portfolios due to its liquidity, market recognition, and established track record. This foundation allows investors to take measured risks with smaller allocations to emerging projects while maintaining substantial exposure to the most proven digital asset.

Expert Predictions and Market Outlook

Short-Term Price Forecasts

Professional analysts offering Bitcoin price prediction for the coming weeks and months consider multiple factors including technical patterns, fundamental developments, and macroeconomic conditions. While precise prediction remains impossible in volatile markets, experienced analysts identify probable scenarios based on historical patterns and current market structure.

Near-term catalysts that might influence Bitcoin’s trajectory include regulatory announcements, macroeconomic data releases, institutional adoption news, and technical breakouts or breakdowns from key chart patterns. Traders conducting comprehensive bitcoin market news today analysis maintain awareness of these potential triggers to position themselves advantageously.

Long-Term Investment Thesis

The long-term bull case for Bitcoin centers on its fixed supply, growing adoption, improving infrastructure, and increasing recognition as a legitimate asset class. Advocates argue that Bitcoin represents a technological breakthrough in money and value transfer, with adoption still in early stages relative to its ultimate potential.

Bears counter that regulatory crackdowns, technological competitors, environmental concerns, or macroeconomic conditions might derail Bitcoin’s growth trajectory. Balanced bitcoin market news today analysis considers both perspectives, helping investors make informed decisions aligned with their personal circumstances and risk tolerance.

Risk Management and Trading Psychology

Position Sizing and Stop-Loss Strategies

Successful cryptocurrency investing requires disciplined risk management regardless of market outlook. Professional traders emphasize position sizing appropriate to individual risk tolerance, ensuring that no single trade can cause catastrophic portfolio damage. Stop-loss orders help protect capital by automatically exiting positions when prices move adversely beyond predetermined thresholds.

Cryptocurrency volatility demands that investors maintain emotional discipline and avoid overleveraging positions. Leverage amplifies both gains and losses, and excessive leverage has destroyed countless trading accounts during sharp market movements. Conservative position sizing and avoiding excessive leverage form the foundation of sustainable trading success.

Emotional Discipline and Decision-Making

Trading psychology profoundly influences investment outcomes, often more than technical or fundamental analysis skills. Fear and greed drive poor decision-making, causing investors to buy at peaks during euphoria and sell at bottoms during panic. Developing systems that remove emotional decision-making from trading improves consistency and long-term results.

Regular portfolio reviews, predetermined entry and exit criteria, and journaling trades help investors maintain discipline and learn from both successes and failures. The most successful cryptocurrency investors combine technical knowledge with psychological mastery, understanding that controlling emotional responses often determines investment outcomes.

Blockchain Technology Developments

Network Upgrades and Scaling Solutions

Blockchain technology continues evolving, with developers working on improvements that enhance Bitcoin’s functionality, scalability, and efficiency. Layer-2 solutions like the Lightning Network enable faster, cheaper transactions by settling multiple transactions off-chain before recording final balances on the main Bitcoin blockchain.

These technological advances address criticisms about Bitcoin’s transaction throughput and fees, expanding potential use cases beyond store of value to include everyday payments. Technical developments feature prominently in forward-looking bitcoin market news today analysis as they influence Bitcoin’s long-term value proposition.

Security Enhancements and Protocol Improvements

Bitcoin’s security model has proven remarkably robust over its 15-year history, with the network never experiencing a successful attack on its core protocol. Ongoing development efforts focus on maintaining this security while improving privacy, efficiency, and functionality through carefully considered protocol upgrades.

The conservative approach to Bitcoin development, prioritizing security and decentralization over rapid feature addition, has contributed to its status as the most trusted cryptocurrency. This philosophical foundation supports Bitcoin’s role as digital gold and underpins much of the bullish long-term investment thesis.

Global Adoption Trends and Use Cases

Emerging Market Adoption

Bitcoin adoption accelerates in countries experiencing currency instability, high inflation, or limited banking infrastructure. Citizens in these regions increasingly turn to Bitcoin as a store of value, medium of exchange, or means of participating in the global economy when traditional financial systems fail to serve their needs.

This grassroots adoption in emerging markets demonstrates Bitcoin’s utility beyond speculation, showcasing its potential to provide financial access and stability for billions of people underserved by traditional banking. These real-world use cases strengthen the fundamental investment case captured in comprehensive bitcoin price analysis.

Payment Integration and Merchant Adoption

While volatility has limited Bitcoin’s everyday payment usage in developed economies, merchant adoption continues growing as payment processors integrate cryptocurrency options. Major payment companies now enable Bitcoin transactions, reducing friction for merchants who want to accept cryptocurrency while immediately converting to local currency to avoid volatility exposure.

As the digital currency market matures and volatility potentially decreases, Bitcoin’s utility as a medium of exchange may expand. Current infrastructure development lays the groundwork for broader payment adoption that could emerge as the ecosystem matures.

Tax Implications and Regulatory Compliance

Cryptocurrency Taxation Guidelines

Investors must understand tax obligations associated with cryptocurrency trading and investment. Most jurisdictions treat Bitcoin as property for tax purposes, meaning that each transaction may trigger taxable events including capital gains or losses. Detailed record-keeping becomes essential for accurate tax reporting and compliance.

Professional guidance from tax advisors familiar with cryptocurrency regulations helps investors navigate complex reporting requirements while optimizing tax efficiency through strategies like tax-loss harvesting. Compliance considerations represent an important component of comprehensive crypto investment strategy that prudent investors incorporate into their planning.

Regulatory Reporting Requirements

Increasing regulatory scrutiny requires that cryptocurrency investors maintain detailed transaction records and report holdings according to local regulations. Exchanges increasingly provide tax reporting tools and documentation to assist users with compliance obligations, reflecting the industry’s maturation and integration with traditional financial oversight.

Understanding regulatory requirements protects investors from potential penalties while supporting the broader legitimacy of cryptocurrency markets. As the industry matures, compliance infrastructure continues improving, making regulatory adherence more straightforward for conscientious investors.

Tools and Resources for Market Analysis

Essential Platforms and Data Sources

Effective bitcoin market news today analysis requires access to reliable data sources and analytical tools. Professional traders utilize platforms providing real-time price data, advanced charting capabilities, on-chain metrics, and news aggregation. These tools enable informed decision-making by presenting comprehensive market information in accessible formats.

On-chain analysis tools provide unique insights unavailable in traditional markets, tracking Bitcoin movement across the blockchain to identify whale activity, exchange flows, and accumulation patterns. These metrics complement traditional technical and fundamental analysis, offering additional perspectives on market dynamics.

Educational Resources and Community Engagement

Continuous learning remains essential in the rapidly evolving cryptocurrency space. Quality educational resources, including podcasts, newsletters, online courses, and community forums, help investors deepen their understanding of Bitcoin and broader cryptocurrency markets. Engaging with knowledgeable communities provides diverse perspectives and helps identify emerging trends.

Critical thinking remains paramount when consuming cryptocurrency content, as the space contains both insightful analysis and misleading information. Developing discernment about source credibility and cross-referencing information across multiple quality sources improves the accuracy of personal bitcoin trading analysis.

Conclusion

The cryptocurrency landscape continues evolving at a remarkable pace, making regular bitcoin market news today analysis indispensable for investors seeking to navigate these dynamic markets successfully. Bitcoin has demonstrated remarkable resilience and growth over its history, establishing itself as the leading digital asset with increasing mainstream acceptance and institutional adoption. However, the volatility and complexity inherent in cryptocurrency markets demand that investors maintain rigorous discipline, continuous education, and balanced perspective.

Successful Bitcoin investing combines technical analysis, fundamental research, macroeconomic awareness, and psychological discipline. By staying informed through comprehensive bitcoin market news today analysis, investors position themselves to identify opportunities, manage risks, and make decisions aligned with their financial goals and risk tolerance. The future of Bitcoin and cryptocurrency remains exciting and uncertain, with potential for both significant gains and substantial losses.

As you continue your cryptocurrency investment journey, commit to regular market analysis, disciplined risk management, and continuous learning. Whether you’re actively trading or holding for the long term, staying informed through quality bitcoin market news today analysis provides the knowledge foundation necessary for investment success. Take action today by bookmarking trusted analysis sources, setting price alerts for key levels, and developing a systematic approach to market monitoring that fits your investment style.