Crypto Founder Dumps Millions in Ethereum What Next?

A popular crypto founder sells millions in Ethereum. Discover what he’s buying now, why it matters, and what investors can learn from the move.

When a popular crypto founder dumps millions in Ethereum, the market pays attention—fast. Not because every large sale automatically signals disaster, but because founders and high-profile builders often have better visibility into narratives, capital flows, and shifting investor psychology than most retail traders. Even if they don’t have “secret information,” they tend to operate closer to the real-time pulse of liquidity, innovation, and risk appetite.

Over the past few weeks, Ethereum has continued to sit at the center of the crypto conversation. It’s still the dominant smart contract platform by ecosystem depth, developer activity, and decentralized finance infrastructure. At the same time, it’s also facing new pressures: rising competition from high-throughput chains, the accelerating adoption of Layer-2 scaling, and the slow but steady shift of attention toward tokenized real-world assets and modular blockchain design.

So when a well-known builder sells a meaningful chunk of Ethereum, headlines begin to swirl. Is this the beginning of a broader exit? Is he bearish on ETH? Or is he simply rotating capital into the next opportunity?

In this article, we’ll unpack the motivations behind a major Ethereum liquidation, explore what this kind of move historically signals, and most importantly—reveal what he’s buying instead. This isn’t about panic-selling or blindly copying whales. It’s about understanding market structure, identifying trends early, and learning how sophisticated investors manage risk and upside.

The Big Move — A Popular Crypto Founder Dumps Millions in Ethereum

Whenever a public figure in crypto makes a large transaction, the story spreads quickly. Sometimes it’s because people assume insider knowledge. Other times, it’s because the crypto market is heavily narrative-driven—sentiment shifts dramatically when prominent names act.

But it’s important to separate emotion from mechanics. A founder selling Ethereum doesn’t automatically mean he’s “done with ETH.” It could indicate a tactical rotation, a tax strategy, or even routine treasury management. In many cases, big Ethereum sales are simply capital allocation decisions.

Still, a move of this size matters because it affects perception. The phrase “popular crypto founder dumps millions in Ethereum” creates urgency, and that urgency can lead to volatility. Traders pile in, algorithms react, and social media amplifies every possible interpretation.

The truth is usually more nuanced: founders aren’t just speculators. They’re operators. They think in cycles, balance sheets, product roadmaps, and opportunity cost. And when they rotate out of Ethereum, it often means they believe the next risk-adjusted opportunity is somewhere else—at least temporarily.

What “Dumping Ethereum” Actually Means (And Why It Isn’t Always Bearish)

The word “dump” implies panic and negativity, but selling Ethereum can be strategically bullish for the broader market. Here’s why: when large holders liquidate, that capital doesn’t disappear. It usually moves into another sector—often something earlier in its growth curve.

A major sale might mean the founder expects Ethereum to underperform for a period. But it might also mean he expects ETH to remain stable while other assets outperform. In portfolio terms, selling Ethereum can be less about rejecting it and more about reallocating to higher beta opportunities.

There’s also the very practical side. Ethereum remains a primary collateral asset in the crypto world. Many large holders use ETH to borrow stablecoins, fund startups, provide liquidity, or invest in other assets. Sometimes selling Ethereum is simply a way to reduce leverage, free up cash flow, or simplify exposure.

The key is not to treat one transaction as prophecy. Instead, watch what comes next: where the capital goes, what narratives the investor is aligning with, and how that fits into broader market conditions.

The Market Context — Why Ethereum Is At a Crossroads

To understand why a founder might sell Ethereum, you need to understand where Ethereum stands right now.

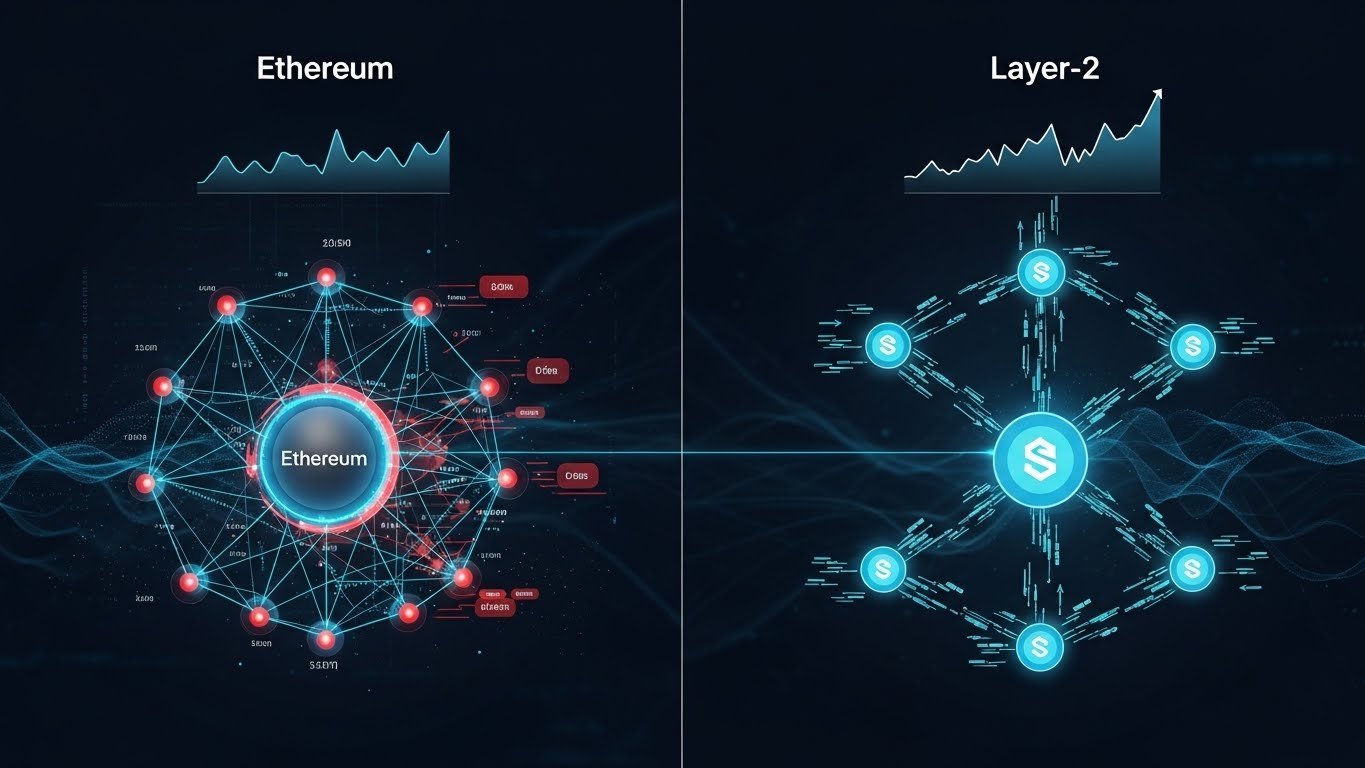

Ethereum remains the backbone of DeFi, NFT infrastructure, and smart-contract-based innovation. Yet it’s also undergoing a shift: usage is increasingly migrating to Layer-2 networks, where transactions are faster and cheaper. That’s a good thing for scalability, but it changes the value capture narrative, especially for those who previously relied on mainnet fees as a bullish indicator.

Meanwhile, competing ecosystems are marketing themselves as faster, cheaper, and more user-friendly. Even if Ethereum remains the settlement layer, market attention often rotates to the chains where the next wave of users is arriving.

On top of that, crypto is increasingly influenced by macro conditions. Interest rates, liquidity cycles, and risk-on appetite shape what capital chooses to hold. In some environments, Ethereum behaves like a “blue chip” crypto asset—solid, widely held, but not always the best performer in a speculative sprint.

This is exactly when sophisticated investors rotate: when a strong asset becomes crowded and the next theme is emerging.

On-Chain Signals — What Whale Wallets Tend to Do Before Big Rotations

When a popular crypto founder dumps millions in Ethereum, it’s rarely a lone event. In many cases, it aligns with wider on-chain data patterns. Large holders—often called whales—don’t move randomly. Their activity typically clusters around liquidity windows, narrative shifts, and volatility compression.

If the founder sold Ethereum during a period of strong liquidity, it suggests planning, not panic. If he sold right after a surge in ETH price, it points to profit-taking. If he sold while the market was quiet, it might suggest he’s positioning ahead of an upcoming catalyst elsewhere.

The most telling part is usually what follows: whether the funds move into stablecoins, into centralized exchanges, into DeFi protocols, or into other tokens. A rotation into stablecoins suggests caution. A rotation into risk assets suggests conviction.

This is why tracking whale wallet behavior matters—not to copy trades blindly, but to understand how smart money interprets the landscape.

Here’s What He’s Buying — The New Targets After Selling Ethereum

So if a popular crypto founder dumps millions in Ethereum, what does he buy next?

While every founder has a different style, the most common “next buys” after a large Ethereum sale tend to cluster into a few strategic categories: assets with strong upside, infrastructure plays, and yield-generating positions.

Below are the most likely allocations—based on how major crypto investors typically rotate when they reduce ETH exposure.

Category One — Bitcoin as the “Safety Trade” After Ethereum

It might sound counterintuitive, but many investors sell Ethereum and increase exposure to Bitcoin. The logic is simple: Bitcoin is still the most widely recognized crypto asset, it has the deepest liquidity, and it tends to outperform during risk-off or uncertainty-driven environments.

Founders who sell Ethereum sometimes do so not because they dislike ETH, but because they want to reduce exposure to smart-contract platform risk and increase exposure to a simpler monetary asset.

In a market where capital is uncertain, Bitcoin dominance often rises. If the founder expects a choppy period, rotating from Ethereum into Bitcoin can be a defensive reallocation rather than a bearish one.

Category Two — Layer-2 Tokens and Scaling Infrastructure

If there’s one theme that continues to grow around Ethereum, it’s scaling. Layer-2 networks are not optional anymore—they’re a core part of Ethereum’s future. That’s why many investors sell Ethereum and buy exposure to the scaling layer, especially if they believe adoption will accelerate.

This category includes tokens and ecosystems tied to rollups, decentralized sequencers, interoperability tooling, and developer infrastructure. Even if Ethereum remains the settlement layer, the user experience increasingly happens on Layer-2 platforms.

Why Layer-2 Might Outperform Ethereum in Certain Cycles

There are cycles where Ethereum behaves like the base asset and Layer-2 tokens behave like growth stocks. When retail interest returns and transaction demand increases, scaling networks often capture attention because they represent “the next step” of the Ethereum story.

If a founder sold Ethereum and bought Layer-2 exposure, he may be betting on usage expansion, cheaper transactions, and ecosystem fragmentation turning into opportunity.

And importantly: he’s still bullish on Ethereum’s future—just expressing that bullishness through the layer where growth is currently accelerating.

Category Three — Real-World Asset Tokenization and Institutional Rails

One of the most powerful emerging narratives is tokenization—the movement of real-world assets (like bonds, funds, invoices, and commodities) onto blockchains. Many of these systems still use Ethereum directly or use Ethereum-compatible platforms, but the investable opportunities are often in protocols building the rails.

Founders are increasingly attracted to this theme because it connects crypto to real cash flow and institutional adoption. It’s less about memes and more about infrastructure—settlement, compliance, and programmable ownership.

If a popular crypto founder dumps millions in Ethereum to buy into tokenization plays, it suggests he’s thinking long-term and institutionally. He may believe the next multi-year wave is about connecting crypto to traditional markets, not just expanding on-chain speculation.

Category Four — DeFi Yield, Staking, and Cash-Flow Strategies

Selling Ethereum doesn’t always mean leaving the ecosystem. In many cases, the capital simply moves into DeFi strategies designed to generate yield or reduce volatility.

This can include stablecoin lending, liquidity provision, or buying assets that provide protocol revenue exposure. Some founders sell spot ETH and shift into yield-bearing forms or positions that are less price-sensitive.

Why DeFi Strategies Often Replace Simple ETH Holding

Holding Ethereum is a directional bet on the asset’s price. But in sideways markets, sophisticated investors prefer strategies that earn yield. A founder might reduce ETH exposure and deploy the funds into staking, liquid staking derivatives, or revenue-sharing protocols to create cash flow while the market consolidates.

This approach can be especially attractive if the founder expects Ethereum to remain stable but wants the portfolio to work harder.

Category Five — High-Conviction Altcoins With Asymmetric Upside

Some founders sell Ethereum because they want more upside than ETH can provide in the near term. This is where altcoins come into play—particularly those tied to AI infrastructure, decentralized storage, modular chains, or emerging consumer apps.

This strategy is the riskiest, but it can be rational. A large Ethereum position is already substantial exposure. If a founder has strong conviction in a smaller project, rotating from ETH into that project can dramatically increase the upside potential—especially if the asset is still early in its growth narrative.

The key for these investors is liquidity and timing. They typically buy in phases, avoid thin markets, and watch whether the narrative has real adoption behind it.

What This Trade Signals for Ethereum Investors

If you’re holding Ethereum, should you be worried? Not necessarily.

One founder selling Ethereum doesn’t change Ethereum’s fundamentals. But it does highlight a truth that many retail traders forget: markets rotate. Even strong assets like Ethereum go through periods where they underperform other narratives. The bigger lesson is that sophisticated investors don’t marry their bags. They treat their portfolio like a dynamic system. They take profits, rotate into emerging themes, hedge risk, and manage liquidity.

If a popular crypto founder dumps millions in Ethereum, it may signal one of the following: Ethereum might be entering a slower performance window relative to faster-growing sectors. Layer-2s and infrastructure plays could be gaining momentum. Tokenization and institutional narratives may be strengthening. Market participants may be shifting from directional bets to yield strategies. None of these are “bad for Ethereum.” They simply reflect how capital behaves during different phases of the cycle.

How Retail Investors Can Learn Without Copying Trades

It’s tempting to track every wallet and mirror every move. But copying a founder’s trade without context is dangerous. You don’t know their time horizon, liquidity needs, tax situation, or risk tolerance.

Instead, treat the event as a research trigger.

If a founder sells Ethereum, ask what sector they’re rotating into and why. Study the narrative. Look at adoption metrics. Observe whether multiple sophisticated investors are making similar shifts. Use the data to build conviction—not fear.

You can also use this moment to reflect on your own portfolio. Are you overexposed to one asset? Are you ignoring newer themes? Are you holding Ethereum because you believe in it—or because it’s comfortable?

Ethereum remains a dominant force. But dominance doesn’t mean it always leads every sprint. The best investors understand when to hold, when to rotate, and when to stay patient.

Conclusion

The headline “popular crypto founder dumps millions in Ethereum” sounds dramatic, but the real story is more strategic than sensational. Large investors often sell Ethereum not because they think it will collapse, but because they believe another sector offers better risk-adjusted returns right now.

What he’s buying—whether it’s Bitcoin, Layer-2 infrastructure, tokenization protocols, DeFi yield strategies, or high-conviction altcoins—reflects the evolving priorities of the crypto market. Each rotation tells you where attention may go next.

For everyday investors, the takeaway isn’t to panic or blindly follow. It’s to understand the logic behind the move and recognize that crypto cycles are built on rotation. Ethereum remains central to the ecosystem, but opportunity often shifts to the edges first—scaling networks, emerging protocols, and new narratives that haven’t yet become crowded.

If you’re holding Ethereum, stay informed, stay flexible, and remember: the smartest money doesn’t just buy and hold. It adapts.

FAQs

Q: Why would a crypto founder sell millions in Ethereum?

A founder might sell Ethereum to take profits, reduce risk, free up liquidity, rebalance into new narratives, or deploy capital into DeFi, Layer-2 opportunities, or tokenization infrastructure.

Q: Does selling Ethereum mean the founder is bearish on ETH?

Not always. Many investors sell Ethereum simply to rotate into assets with higher short-term upside or to shift into yield strategies. It can be tactical rather than a long-term negative view.

Q: What are the most common assets whales buy after selling Ethereum?

Common rotations include Bitcoin, Layer-2 tokens, protocols tied to real-world asset tokenization, revenue-generating DeFi platforms, and select high-conviction altcoins.

Q: Should retail investors sell Ethereum if a founder sells?

Retail investors shouldn’t automatically react. A founder’s situation is different. Instead, use the event to study market trends, assess your own risk, and understand where capital is flowing.

Q: What does this mean for Ethereum’s future?

Ethereum remains foundational to crypto. Large sales may cause short-term volatility, but Ethereum’s ecosystem strength, developer adoption, and scaling roadmap keep it central. Rotations often reflect opportunity elsewhere—not Ethereum’s failure.

Also More: Best Crypto to Buy Now XRP, Solana, Cardano