Bitcoin DeFi Grows as Mezo & Bitget Launch Rewards

Bitcoin DeFi is expanding fast as Mezo and Bitget Wallet introduce new rewards programs that boost BTC utility, yield opportunities, and user adoption.

Bitcoin has long been viewed as digital gold—a secure, decentralized store of value designed to protect wealth over time. While that narrative remains powerful, the Bitcoin ecosystem is entering a new phase. Today, Bitcoin is no longer just about holding and waiting. Through the rapid rise of Bitcoin DeFi, BTC is evolving into an active financial asset capable of generating yield, supporting decentralized applications, and participating in on-chain economic activity without sacrificing its core principles.

This transformation is being driven by innovation at multiple levels of the ecosystem. Among the most notable developments is the emergence of incentive-driven adoption. Rewards programs are becoming one of the most effective ways to introduce users to Bitcoin DeFi, guiding them toward meaningful participation rather than passive speculation. Two major players—Mezo and Bitget Wallet—are now at the center of this shift, each rolling out new reward systems designed to accelerate Bitcoin-based decentralized finance.

Mezo is focusing on network-level incentives that encourage users to bridge assets, mint stablecoins, interact with vaults, and provide liquidity, all while maintaining a Bitcoin-centric experience. At the same time, Bitget Wallet is enhancing the user layer by consolidating reward opportunities into a single, accessible hub that simplifies discovery and participation. Together, these initiatives signal a turning point for Bitcoin DeFi, where usability, incentives, and real utility converge.

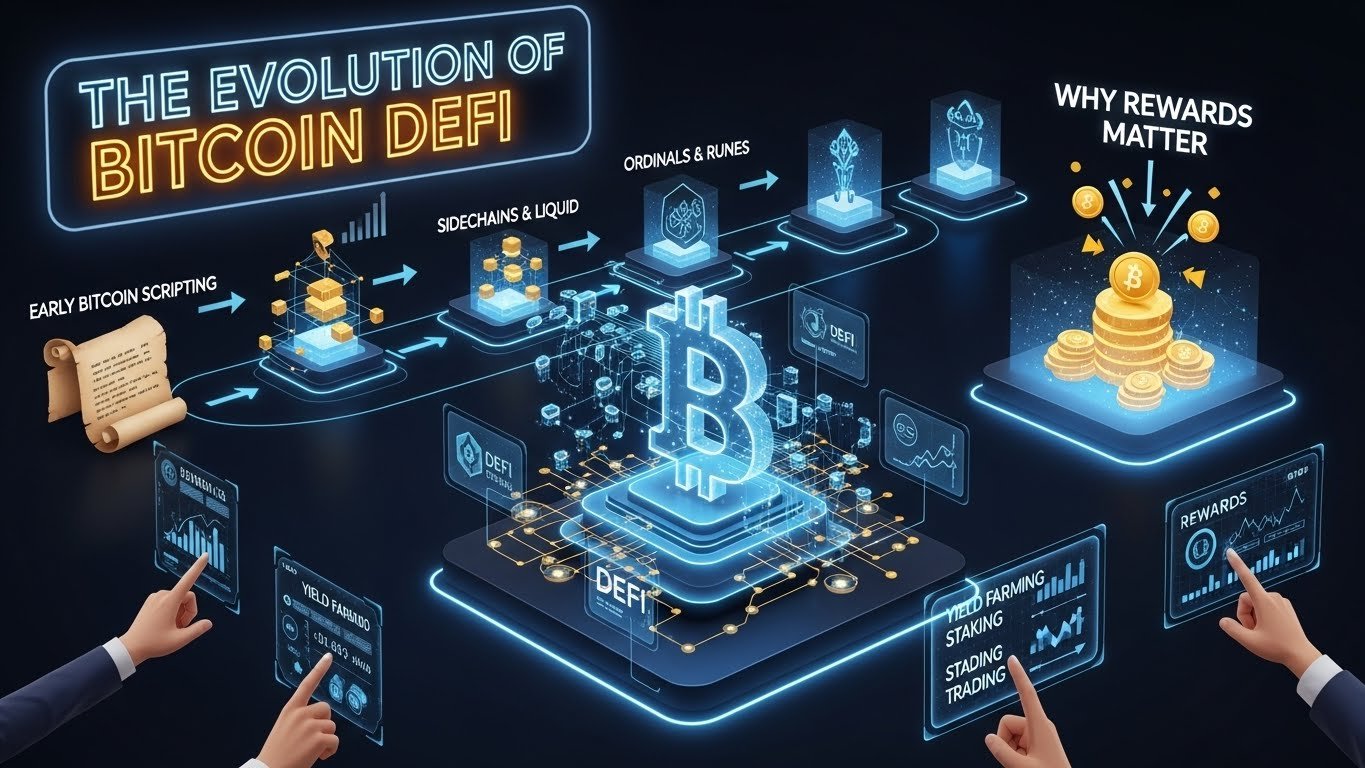

The evolution of Bitcoin DeFi and why rewards matter

For much of its history, Bitcoin offered limited financial functionality beyond peer-to-peer transfers and long-term storage. While other blockchains experimented with smart contracts and decentralized applications, Bitcoin remained intentionally conservative. That caution preserved security and trust but limited innovation. Bitcoin DeFi changes this dynamic by enabling decentralized financial tools that respect Bitcoin’s ethos while unlocking new possibilities.

Rewards play a crucial role in this evolution. In traditional finance, incentives like cashback, loyalty points, and interest bonuses encourage engagement. In Bitcoin DeFi, rewards serve a similar purpose but with deeper implications. They motivate users to explore new protocols, provide liquidity, and test emerging infrastructure that needs real-world usage to mature.

Without incentives, many Bitcoin holders would remain hesitant to interact with DeFi systems. Rewards reduce friction, compensate early adopters for risk, and help bootstrap liquidity. As more users participate, ecosystems become stronger, more efficient, and more resilient. This feedback loop is one of the primary reasons Bitcoin DeFi is gaining momentum now rather than years ago.

Mezo’s vision for Bitcoin-native decentralized finance

Mezo positions itself as a Bitcoin-first financial ecosystem designed to make BTC productive without compromising decentralization or self-custody. Instead of forcing users into unfamiliar token economies, Mezo builds its framework around Bitcoin-aligned incentives and actions that feel intuitive to long-term BTC holders.

At the heart of Mezo’s approach is a rewards system that recognizes and incentivizes real on-chain behavior. Users earn rewards by participating in core ecosystem activities such as bridging assets, minting Bitcoin-backed stablecoins, swapping tokens, depositing funds into vaults, and providing liquidity. This structure ensures that rewards are tied directly to actions that strengthen the network.

What makes Mezo especially relevant to Bitcoin DeFi is its emphasis on participation rather than speculation. Users are not rewarded simply for holding a token. Instead, they earn rewards by contributing to the ecosystem’s functionality and liquidity. This design aligns incentives with long-term sustainability rather than short-term hype.

Mats rewards and ecosystem engagement

Mezo’s reward points, often referred to as mats, act as a unifying incentive mechanism across the platform. Mats are earned through verified on-chain actions, reinforcing the idea that value comes from participation. This approach reflects a broader trend in Bitcoin DeFi, where projects are moving away from passive reward farming and toward engagement-based incentives.

For users, mats provide a clear reason to explore different features of the ecosystem. Each interaction deepens familiarity with Bitcoin-based DeFi tools while contributing to overall network health. For the protocol, mats help distribute rewards in a way that encourages liquidity, stability, and consistent usage.

This system also makes Bitcoin DeFi more approachable. By framing rewards in a way that resembles loyalty points, Mezo lowers the learning curve for users who may be new to decentralized finance but comfortable with Bitcoin itself.

Bitcoin-denominated earning and Mezo Earn

A critical challenge in decentralized finance is misaligned incentives. Many platforms offer yield in volatile or unfamiliar tokens, which can discourage conservative Bitcoin holders. Mezo addresses this issue through Bitcoin-denominated earning opportunities, allowing users to earn fees and rewards while maintaining BTC exposure.

Mezo Earn represents a shift toward Bitcoin-native yield generation. By enabling users to lock BTC in self-custodial systems that generate Bitcoin-based returns, Mezo reinforces trust and aligns incentives with user preferences. This approach strengthens the case for Bitcoin DeFi as a legitimate extension of the Bitcoin ecosystem rather than a departure from it.

As more users seek yield without selling their BTC, Bitcoin-denominated earning models could become a defining feature of the next generation of decentralized finance.

Swaps, vaults, and practical utility in Bitcoin DeFi

Utility is where Bitcoin DeFi either succeeds or fails. Rewards may attract attention, but long-term adoption depends on whether users find real value in the tools provided. Mezo’s swaps and vaults are designed to offer that value by enabling liquidity access, stablecoin minting, and yield opportunities without abandoning Bitcoin principles.

Vaults allow users to deposit assets into structured strategies that aim to generate returns. While these mechanisms introduce risk, they also unlock financial flexibility that was previously unavailable to Bitcoin holders. Mezo emphasizes transparency and encourages users to understand how vaults operate, reinforcing responsible participation.

Swaps, meanwhile, enable seamless asset movement within the ecosystem, supporting liquidity and price discovery. Together, these tools form the backbone of Mezo’s Bitcoin DeFi offering, turning Bitcoin from a static asset into an active financial instrument.

Bitget Wallet’s role in expanding Bitcoin DeFi access

While protocols like Mezo build the infrastructure of Bitcoin DeFi, wallets determine how users interact with it. For many participants, the wallet is the only interface they ever see. Recognizing this, Bitget Wallet has expanded its role from simple asset storage to an engagement platform that connects users with decentralized opportunities.

The introduction of a centralized rewards hub within Bitget Wallet simplifies participation by aggregating multiple incentive programs in one place. Users can discover tasks, track progress, and claim rewards without navigating complex interfaces or external platforms. This ease of use is essential for scaling Bitcoin DeFi beyond early adopters.

By integrating reward programs directly into the wallet experience, Bitget Wallet reduces barriers to entry and encourages consistent engagement. Users are more likely to explore Bitcoin-based DeFi opportunities when they are presented clearly and conveniently.

Weekly campaigns and gamified participation

Bitget Wallet’s rewards strategy includes recurring campaigns and task-based challenges that create a sense of momentum and excitement. These programs encourage users to return regularly, complete on-chain actions, and experiment with new features.

Gamification is particularly effective in Bitcoin DeFi, where many users are cautious and analytical. Small, achievable tasks paired with visible rewards help users build confidence and familiarity. Over time, this leads to deeper engagement and greater comfort with decentralized finance tools.

How rewards reshape liquidity in Bitcoin DeFi

Liquidity is the lifeblood of any financial system, and Bitcoin DeFi is no exception. Incentives directly influence where liquidity flows and how long it stays. By rewarding specific actions, platforms like Mezo and Bitget Wallet can guide capital toward areas that need growth and stability.

When users are rewarded for providing liquidity, minting stablecoins, or depositing into vaults, the ecosystem benefits from increased depth and efficiency. Better liquidity leads to tighter spreads, smoother swaps, and more reliable yield strategies. This, in turn, attracts additional users, reinforcing the growth cycle.

Rewards also help align user behavior with protocol goals. Instead of chasing unsustainable yields, participants are encouraged to support the long-term health of the ecosystem. This alignment is essential for the maturation of Bitcoin DeFi.

Risks and responsible participation in Bitcoin DeFi

Despite its promise, Bitcoin DeFi is not without risk. Smart contract vulnerabilities, bridge dependencies, and market volatility all pose potential challenges. Rewards should never be viewed as guaranteed profits but as compensation for participation and risk.

Users should take time to understand how protocols operate, how funds are managed, and what assumptions underlie yield strategies. Responsible platforms emphasize education and transparency, encouraging users to make informed decisions rather than blindly chasing incentives.

Wallet-level rewards also require caution. As incentive programs grow in popularity, so do scams and impersonation attempts. Verifying official channels and exercising basic security hygiene remains critical in the expanding Bitcoin DeFi landscape.

The future of Bitcoin DeFi incentives

The growth of Bitcoin DeFi suggests that incentives will continue to evolve. Future reward programs are likely to become more sophisticated, focusing on long-term engagement rather than short-term spikes. Transparency, sustainability, and Bitcoin-aligned economics will be key differentiators.

Mezo’s focus on Bitcoin-denominated participation and Bitget Wallet’s emphasis on user-friendly reward discovery represent complementary strategies. One strengthens the foundation of Bitcoin DeFi, while the other broadens access and adoption. Together, they illustrate how the ecosystem is maturing.

As infrastructure improves and user confidence grows, Bitcoin DeFi may redefine how Bitcoin is used—transforming it from passive wealth storage into an active participant in decentralized global finance.

Conclusion

Bitcoin DeFi is entering a critical growth phase, driven by innovation, usability, and well-designed incentives. Mezo’s rewards programs demonstrate how network-level incentives can encourage meaningful participation while staying true to Bitcoin’s principles. Bitget Wallet’s reward-focused enhancements show how wallets can serve as gateways that simplify access and engagement.

Together, these developments highlight a broader shift in the Bitcoin ecosystem. Utility is no longer optional, and incentives are no longer secondary. As Bitcoin DeFi continues to expand, rewards programs will play a central role in shaping adoption, liquidity, and long-term sustainability.

FAQs

Q: What is Bitcoin DeFi?

Bitcoin DeFi refers to decentralized financial services built around Bitcoin or Bitcoin-aligned systems, enabling lending, borrowing, swapping, and yield generation without centralized intermediaries.

Q: How do rewards help Bitcoin DeFi grow?

Rewards incentivize users to participate, provide liquidity, and test new infrastructure, helping bootstrap ecosystems and accelerate adoption.

Q: Is Bitcoin DeFi safe?

Bitcoin DeFi carries risks similar to other DeFi systems, including smart contract and market risks. Users should always conduct research and understand the protocols they use.

Q: Why are Bitcoin-denominated rewards important?

Bitcoin-denominated rewards align incentives with BTC holders’ preferences, allowing users to earn while maintaining exposure to Bitcoin rather than unfamiliar tokens.

Q: Can beginners participate in Bitcoin DeFi?

Yes, especially through user-friendly wallets and reward hubs that simplify discovery and guide users through tasks designed for gradual learning.

Also More: Bitcoin Price Prediction BTC Holds $90K