Cryptocurrencies Price Prediction Asia Wrap Jan 30

Cryptocurrencies price prediction for Bitcoin, Ethereum & Worldcoin in the Asian session on January 30 with key levels, trends, and market outlook.

Asian trading session on January 30 opens with cryptocurrencies under renewed pressure, reflecting a broader shift in global market sentiment. Bitcoin, Ethereum, and Worldcoin are all trading lower, prompting traders and long-term investors alike to reassess near-term expectations. This moment is particularly important because Asian hours often set the tone for liquidity, volatility, and momentum across the rest of the trading day.

In this cryptocurrencies price prediction, the focus is not on short-lived speculation but on understanding how current price action fits into the broader market structure. Crypto markets are once again behaving like high-risk assets, reacting to macro uncertainty, tightening liquidity expectations, and fragile investor confidence. When this dynamic dominates, price movements become sharper, support zones are tested more aggressively, and emotional trading increases.

Bitcoin continues to act as the market’s anchor, with Ethereum closely tracking its direction while showing its own signs of relative weakness. Worldcoin, as a smaller-cap asset, is experiencing amplified volatility, reflecting how quickly sentiment can swing in thinner markets. This Asian wrap provides a detailed cryptocurrency price prediction framework for all three assets, identifying key technical zones, momentum signals, and realistic scenarios for the days ahead.

Rather than offering exaggerated targets, this analysis focuses on probability, structure, and confirmation—key elements that define successful decision-making in volatile crypto environments.

Asian Wrap 30 January: Why Today’s Session Is Critical

Asian trading sessions often act as a bridge between U.S. market volatility and European positioning. When selling pressure carries over into Asia, it suggests that bearish sentiment is not confined to one region but is becoming globally synchronized. That is exactly what today’s price action suggests.

From a cryptocurrencies price prediction perspective, this matters because synchronized selling typically weakens bounce attempts. Buyers become more selective, waiting for clearer confirmation before committing capital. As a result, price can drift lower even without dramatic news.

Another important factor is liquidity. Asian hours can be thinner compared to U.S. sessions, meaning price moves can appear exaggerated. However, when those moves hold into higher-liquidity sessions, they gain credibility. January 30 is shaping up to be one of those moments where traders are watching closely to see whether early weakness stabilizes—or accelerates.

This environment favors patience, discipline, and scenario planning over aggressive positioning.

Bitcoin Price Prediction: BTC Faces a Defining Test

Bitcoin remains the cornerstone of every cryptocurrencies price prediction because it dictates capital flow, sentiment, and technical direction across the market. As of the Asian session on January 30, Bitcoin is trading well below recent highs, reflecting a clear shift from bullish momentum to defensive positioning.

Bitcoin Market Structure and Trend Context

From a broader perspective, Bitcoin is transitioning from an expansion phase into a consolidation or corrective phase. This does not necessarily signal the end of a larger bullish cycle, but it does indicate that the market is digesting gains and reassessing risk.

In short-term structure, Bitcoin has broken below several minor support zones, turning them into resistance. This behavior is typical during corrective phases and often leads to choppy, emotionally driven trading. For any Bitcoin price prediction to turn constructive again, BTC must show evidence of stabilization rather than simply bouncing on oversold conditions.

Key Bitcoin Support and Resistance Levels

The most important support zone sits near a major psychological round number that traders closely monitor. This level represents both technical significance and sentiment anchoring. If Bitcoin holds above this zone, it increases the likelihood of sideways consolidation rather than a deeper correction.

On the upside, Bitcoin faces layered resistance formed by prior breakdown points. These levels act as supply zones where sellers previously overwhelmed buyers. A strong reclaim and close above these areas would signal that bullish momentum is returning and that the market is ready to resume higher-timeframe trends.

Bitcoin Forecast Scenarios

In a conservative cryptocurrencies price prediction, Bitcoin has three likely paths:

If support holds and volatility contracts, BTC may enter a range-bound phase that allows momentum indicators to reset. If support fails decisively, downside acceleration becomes likely as stop-loss orders trigger and sentiment deteriorates. If Bitcoin reclaims resistance with strong volume, short covering could fuel a sharp relief rally.

At this stage, confirmation matters more than prediction. Bitcoin is at a point where market participants must let price prove direction.

Ethereum Price Prediction: ETH Struggles to Regain Strength

Ethereum often reflects broader crypto sentiment but with additional sensitivity to liquidity conditions. In today’s Asian session, ETH is underperforming relative to Bitcoin, highlighting weaker demand and cautious positioning.

Ethereum’s Relative Weakness Explained

One of the challenges in this Ethereum price prediction is that ETH has not yet demonstrated the same resilience that Bitcoin sometimes shows during corrections. When capital becomes defensive, traders often rotate first into Bitcoin, leaving Ethereum more exposed to downside pressure.

Ethereum is also facing technical headwinds, including rejection from key moving averages and previous breakout zones. This reinforces the idea that ETH must rebuild momentum rather than assume an immediate recovery.

ETH Technical Outlook and Critical Zones

Ethereum’s most important task is to defend its recent swing low. Failure to do so would open the door to further downside and potentially shake confidence among short-term holders. Holding this zone, however, could allow ETH to stabilize and form a base.

On the upside, ETH must reclaim a prior rejection zone that now acts as resistance. A strong move above this level would suggest that buyers are regaining control and that Ethereum can begin outperforming again.

Ethereum Price Prediction Scenarios

A realistic cryptocurrencies price prediction for Ethereum recognizes that ETH may lag during early recovery phases. If Bitcoin stabilizes but does not break higher, ETH could continue consolidating. If Bitcoin resumes a strong uptrend, Ethereum is likely to follow with increased volatility.

For now, Ethereum remains in a repair phase, requiring patience from traders looking for confirmation rather than anticipation.

Worldcoin Price Prediction: Volatility Defines the Outlook

Worldcoin occupies a different category within this cryptocurrencies price prediction analysis. As a smaller-cap token, it is more sensitive to sentiment shifts, liquidity changes, and speculative flows.

Why Worldcoin Moves More Aggressively

Worldcoin’s volatility is not a flaw—it is a structural characteristic. When confidence is high, capital flows into higher-risk assets quickly. When confidence fades, those same assets are sold aggressively. This dynamic explains why Worldcoin often experiences sharper percentage moves than Bitcoin or Ethereum.

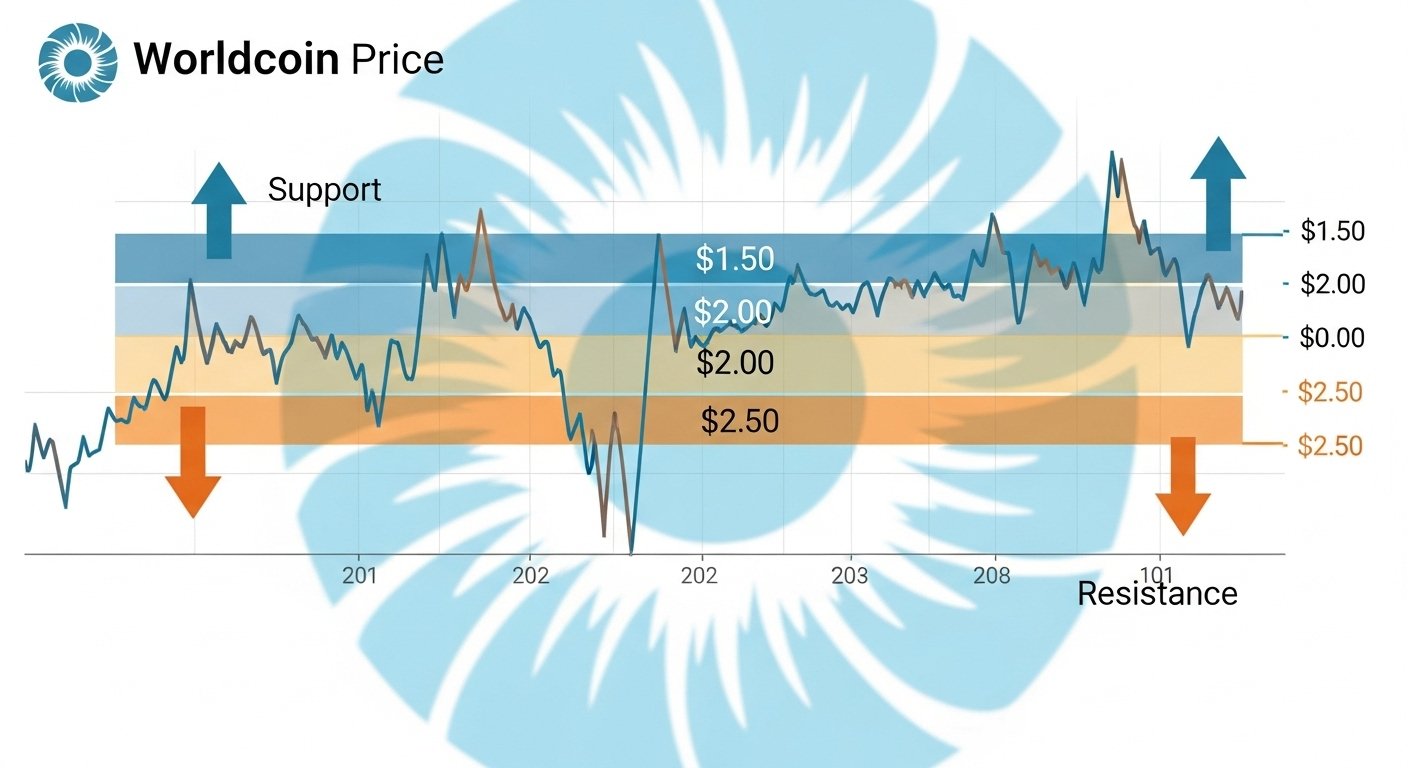

During the January 30 Asian session, Worldcoin is trading near a critical inflection point. Price is compressed between nearby support and resistance, suggesting that a directional move may be approaching.

Key Levels in the Worldcoin Price Outlook

Support lies near the lower boundary of the recent trading range. If this level fails, downside momentum could accelerate due to thin order books. Resistance sits just above current price, marking the area where sellers have repeatedly emerged.

For any Worldcoin price prediction to turn bullish, the token must reclaim resistance and hold above it with conviction. Without that confirmation, rallies are likely to remain short-lived.

Worldcoin Forecast Scenarios

If broader market sentiment improves, Worldcoin could rebound quickly due to its high beta nature. If macro pressure persists, Worldcoin may continue underperforming as traders reduce exposure to speculative assets.

Worldcoin offers opportunity—but only for those who respect its risk profile.

Macro Environment: The Hidden Driver of Crypto Prices

No cryptocurrencies price prediction is complete without addressing the macro backdrop. Current market conditions are shaped by uncertainty around monetary policy, interest rates, and global liquidity. These factors influence whether investors seek risk or prioritize capital preservation.

When yields are attractive and liquidity tightens, speculative assets often struggle. This does not negate crypto’s long-term potential, but it does affect short-term price behavior. The January 30 session reflects this reality, with traders reacting defensively rather than aggressively buying dips.

Understanding this context helps explain why technical levels may not behave as expected. Support can break faster, and recoveries may require stronger confirmation than during bullish phases.

Market Psychology During Asian Sessions

Asian sessions often reveal whether markets are stabilizing or preparing for continuation. When selling slows and volatility compresses, it suggests exhaustion. When selling persists without meaningful bounce attempts, it signals unresolved fear.

Today’s session shows cautious behavior rather than panic, which is an important distinction. In a cryptocurrencies price prediction, this often points to consolidation rather than collapse—provided key levels hold.

Psychology matters as much as charts. Traders who recognize emotional extremes gain an edge in volatile environments.

Risk Management in Cryptocurrency Price Prediction

The most overlooked aspect of any cryptocurrencies price prediction is risk management. Predictions fail not because analysis is wrong, but because traders ignore invalidation points.

Every bullish or bearish thesis must have a clear level where it no longer applies. In current conditions, protecting capital is more important than maximizing upside. Volatility rewards discipline and punishes overconfidence.

Successful crypto participants focus on process, not prediction accuracy.

Conclusion

The Asian wrap for January 30 highlights a crypto market at a crossroads. Bitcoin is testing critical support, Ethereum is rebuilding momentum, and Worldcoin is hovering near a volatility trigger point. This cryptocurrencies price prediction emphasizes scenarios rather than certainty, reflecting a market dominated by macro influence and cautious sentiment.

If key support zones hold, consolidation and stabilization become likely. If they fail, downside continuation cannot be ignored. The coming sessions will reveal whether fear is peaking—or just beginning.

For traders and investors alike, patience, confirmation, and disciplined execution remain the most valuable tools.

FAQs

Q: Is now a good time to buy Bitcoin?

This depends on risk tolerance. A conservative cryptocurrencies price prediction suggests waiting for confirmation that support is holding or resistance is reclaimed before entering aggressively.

Q: Why is Ethereum underperforming Bitcoin?

Ethereum often lags during defensive market phases as capital prioritizes Bitcoin. ETH typically regains strength once confidence returns.

Q: Is Worldcoin suitable for long-term holding?

Worldcoin carries higher volatility and risk. It may suit speculative strategies more than conservative long-term portfolios.

Q: How important is macro news for crypto prices?

Macro conditions strongly influence short-term crypto price action, especially during periods of tightening liquidity and uncertainty.

Q: What should traders watch next?

Traders should monitor support and resistance behavior, volume confirmation, and shifts in overall market sentiment rather than focusing solely on price targets.

Also More: Top Crypto Losers Worldcoin, Chiliz, Hyperliquid Crash