5 Warning Signs Across Bitcoin, Gold, and Global Markets

five major warning signs emerging across Bitcoin, gold, and global markets that investors should not ignore in today’s uncertain economy.

Financial markets rarely send clear signals before major shifts. Instead, they whisper. Those whispers appear as subtle warning signs—small changes in behavior that only make sense when viewed together. Right now, those signals are emerging simultaneously across Bitcoin, gold, and global financial markets, and that alignment is not accidental.

In previous cycles, assets often moved independently. Bitcoin traded as an experimental technology play, gold served as a traditional safe haven, and equities followed economic growth narratives. Today, those boundaries are blurring. Macro forces such as rising debt, tightening liquidity, geopolitical uncertainty, and shifting investor psychology are influencing every major asset class at once. When multiple markets begin flashing similar warning signs, it suggests the system itself is under strain.

Bitcoin’s volatility is no longer just a crypto story. Gold’s strength is no longer just about inflation hedging. Global markets are no longer insulated by diversification alone. These developments point toward a deeper structural change in how capital moves and how risk is priced.

This article explores five critical warning signs emerging across Bitcoin, gold, and global markets. Each one highlights a growing imbalance that investors, traders, and observers should understand—not to predict immediate collapse, but to recognize that the environment is changing.

Liquidity Is Quietly Drying Up

Liquidity is the invisible force that keeps markets functioning smoothly. When liquidity is abundant, price dips are shallow, volatility stays contained, and confidence remains high. When liquidity tightens, even small shocks can create exaggerated price movements. One of the most important warning signs today is that liquidity is becoming more fragile across asset classes.

Bitcoin’s Sensitivity to Liquidity Shifts

Bitcoin acts as a real-time liquidity gauge. Because it trades continuously and relies heavily on speculative capital, it often reacts before traditional markets do. When liquidity is strong, Bitcoin rallies aggressively. When liquidity tightens, price action becomes erratic, rebounds weaken, and selling pressure intensifies.

These shifts are not random. They reflect changes in risk tolerance and capital availability. When Bitcoin struggles to sustain upward momentum despite positive narratives, it can be an early warning sign that liquidity conditions are deteriorating beneath the surface.

Liquidity Stress in Global Markets

Global markets can appear stable even as liquidity weakens. Equity indices may remain elevated while funding markets become more sensitive and volatility quietly builds. This mismatch creates a false sense of security. When liquidity finally breaks, the adjustment is often sudden and violent.

Liquidity stress does not announce itself with headlines. It reveals itself through widening price swings, weaker market depth, and rising correlations. These subtle signals are among the most overlooked warning signs in modern markets.

Gold’s Role During Liquidity Tightening

Gold often benefits when liquidity tightens, but not always for the same reason. Sometimes gold rises because investors seek safety. Other times, gold rises because confidence in financial systems weakens. Both scenarios reflect stress. When gold strengthens while risk assets become unstable, it reinforces the presence of systemic warning signs.

Gold’s Rally Looks Increasingly Emotional

Gold has always been associated with fear, preservation, and trust. However, not all gold rallies are equal. A slow, steady rise driven by fundamentals differs greatly from a sharp surge driven by emotion. One of the most visible warning signs today is that gold’s strength is beginning to resemble crowd behavior rather than calm hedging.

From Safe Haven to Momentum Trade

When investors rush into gold quickly, the narrative often shifts. Gold stops being a quiet hedge and starts acting like a momentum asset. This transition matters because crowded trades carry risk. When too many investors move in the same direction, reversals become sharper and more disruptive. An emotionally driven gold rally can signal growing fear across markets. Fear-driven behavior is one of the strongest warning signs because it spreads rapidly and overrides rational decision-making.

Gold as a Confidence Barometer

Gold is not just a commodity; it is a reflection of trust in currencies, governments, and financial systems. When gold attracts excessive attention, it often means investors are questioning the stability of the broader system. That questioning rarely stays isolated. It spills into equities, bonds, and alternative assets like Bitcoin. This erosion of confidence is subtle at first but powerful over time. It represents a psychological warning sign that markets are transitioning from optimism to caution.

Implications for Bitcoin

Bitcoin sometimes benefits from the same distrust that fuels gold rallies. However, Bitcoin also depends on liquidity and risk appetite. When gold rises sharply but Bitcoin struggles, it suggests that investors want protection without volatility. That divergence is a meaningful warning sign about shifting preferences in capital allocation.

Hidden Leverage Is Building Across the System

One of the most dangerous warning signs in any market cycle is invisible leverage. Leverage magnifies gains, but it also magnifies losses. When leverage grows quietly, markets become unstable long before prices reflect the risk.

The Growth of Nontraditional Risk

Leverage no longer resides only in banks. It now exists in hedge funds, private vehicles, derivatives, and algorithmic strategies. These structures often lack transparency, making it difficult to assess the true level of risk in the system. When leverage is hidden, markets can appear healthy while becoming increasingly fragile. This imbalance is one of the clearest systemic warning signs.

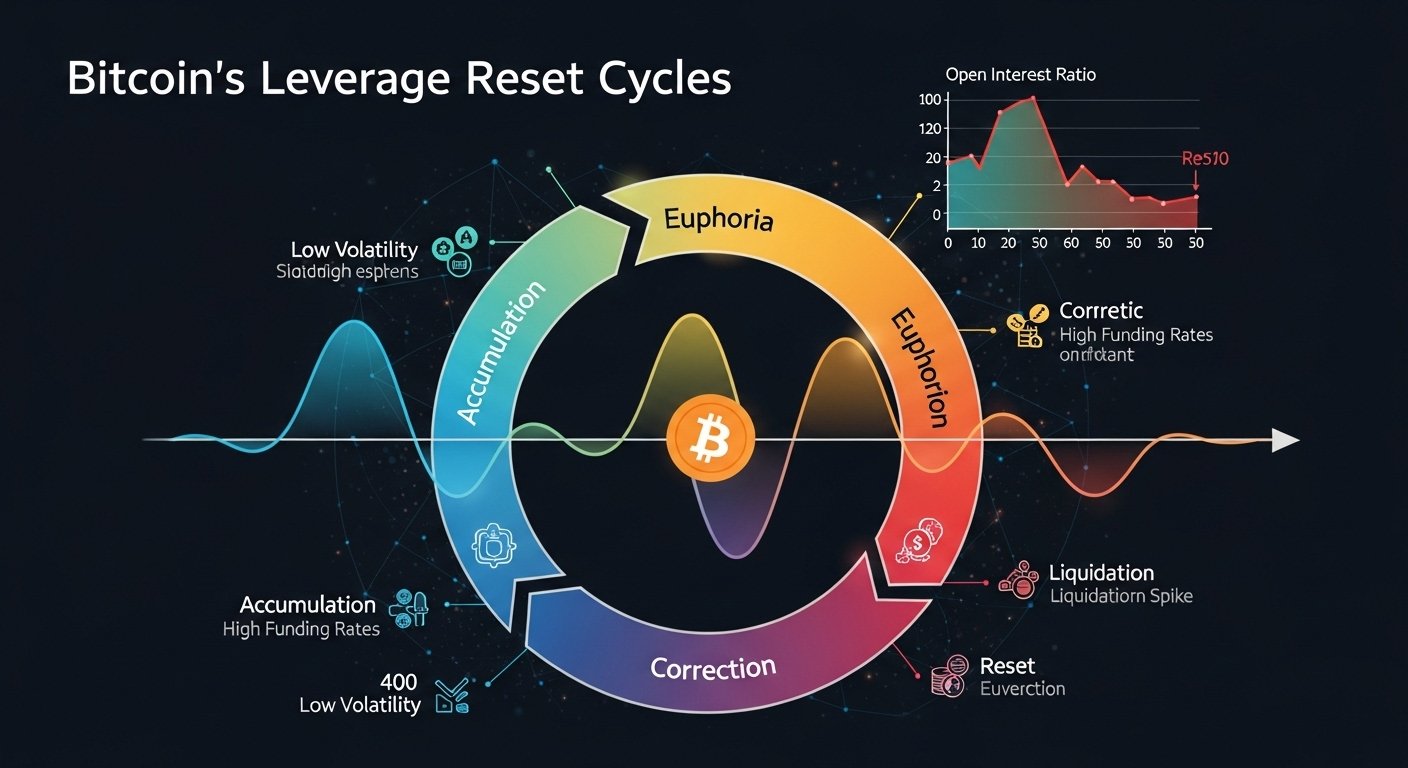

Bitcoin’s Leverage Reset Cycles

In Bitcoin markets, leverage is easier to observe. Sudden liquidations, extreme volatility, and cascading price moves reveal when speculation becomes excessive. These events are not isolated to crypto; they often coincide with stress elsewhere. When Bitcoin experiences repeated leverage flushes, it may indicate broader risk aversion is emerging. That makes crypto market behavior an early warning sign for global sentiment.

Gold and Forced Selling Risk

Gold is generally less leveraged, but it is not immune. During periods of stress, investors may sell gold to meet margin calls elsewhere. This behavior can create sharp, temporary drops even in traditionally stable assets. Such forced selling episodes reinforce how interconnected modern markets have become—and why leverage remains a critical warning sign.

Sovereign Debt Pressure Is Rising

Sovereign debt lies at the heart of the global financial system. When confidence in government borrowing weakens, the effects ripple outward. Rising debt burdens and refinancing risks represent one of the most underappreciated warning signs in today’s markets.

Why Government Debt Matters

Government bonds influence interest rates, currency values, and asset pricing across the economy. When debt levels become concerning, investors demand higher compensation for risk. That adjustment tightens financial conditions and reduces liquidity. This process unfolds gradually until it doesn’t. Bond market stress often builds quietly, making it a delayed but powerful warning sign.

Gold’s Relationship With Fiscal Stress

Gold has historically performed well during periods of fiscal uncertainty. When investors question the sustainability of government finances, gold becomes an alternative store of value. Persistent strength in gold prices can reflect growing concern about long-term debt trajectories. This behavior does not imply immediate crisis, but it does signal shifting expectations. Those shifts are important warning signs for future market dynamics.

Bitcoin’s Emerging Role in a Debt-Heavy World

Bitcoin is increasingly discussed as an alternative to debt-based monetary systems. While still volatile, its fixed supply narrative resonates during periods of fiscal stress. Whether Bitcoin benefits or struggles depends on liquidity conditions, but the conversation itself is a warning sign that trust in traditional structures is evolving.

Correlations Are Breaking Traditional Diversification

Diversification works best when assets behave differently. When correlations rise, diversification fails. One of the final and most dangerous warning signs is when assets that normally offset each other begin moving together.

The Fragility of One-Directional Markets

When markets are dominated by similar positioning and narratives, they become vulnerable. Investors may believe they are diversified, but in reality, they are exposed to the same underlying risk. This creates sharp, synchronized moves during stress events. Correlation spikes often occur late in cycles, making them powerful warning signs of instability.

Gold as the Preferred Hedge

When gold becomes the dominant hedge across portfolios, it suggests fear is no longer isolated. Widespread hedging behavior indicates that uncertainty has become systemic rather than sector-specific. This transition marks a psychological shift and reinforces the presence of broader warning signs across markets.

Bitcoin’s Correlation Identity Crisis

Bitcoin’s changing correlation profile makes it especially informative. When Bitcoin trades like a risk asset, it reflects liquidity dynamics. When it trades alongside gold, it reflects monetary concern. Rapid changes between these behaviors are themselves warning signs that markets are searching for stability.

Conclusion

Markets rarely collapse without warning. The signals appear gradually, overlapping and reinforcing one another. Today, warning signs across Bitcoin, gold, and global markets suggest that the financial environment is becoming more fragile.

Liquidity is thinning. Gold’s rally is growing emotional. Leverage is quietly expanding. Sovereign debt pressures are increasing. Correlations are shifting. None of these factors alone guarantees a downturn, but together they form a pattern that deserves attention.

The goal is not fear—it is awareness. Investors who recognize warning signs early gain the ability to adapt rather than react. In an interconnected world, understanding how Bitcoin, gold, and global markets move together is no longer optional. It is essential.

FAQs

Q: Are warning signs across Bitcoin and gold always negative?

Not always. Warning signs indicate change, not guaranteed collapse. They highlight shifts in liquidity, sentiment, or structure that require closer attention.

Q: Why does Bitcoin react faster to market stress?

Bitcoin trades continuously and relies heavily on speculative capital, making it highly sensitive to liquidity and sentiment changes.

Q: Does rising gold always mean fear?

Gold can rise for many reasons, but rapid, emotionally driven rallies often signal broader uncertainty and act as warning signs.

Q: How does sovereign debt affect everyday investors?

Rising debt influences interest rates, inflation expectations, and asset valuations, impacting portfolios even without immediate crises.

Q: What should investors do when warning signs appear?

Investors can reassess risk exposure, reduce leverage, prioritize liquidity, and avoid emotional decision-making during uncertain periods.

See More: Bitcoin’s 7% Drop to $77K Signals Possible Cycle Low