Altcoin Season Pattern 184x Potential for ETH & XRP

Altcoin season pattern signals major upside. See how a fresh chart frames 184x potential targets for ETH, XRP, SOL, and ADA with key levels to watch.

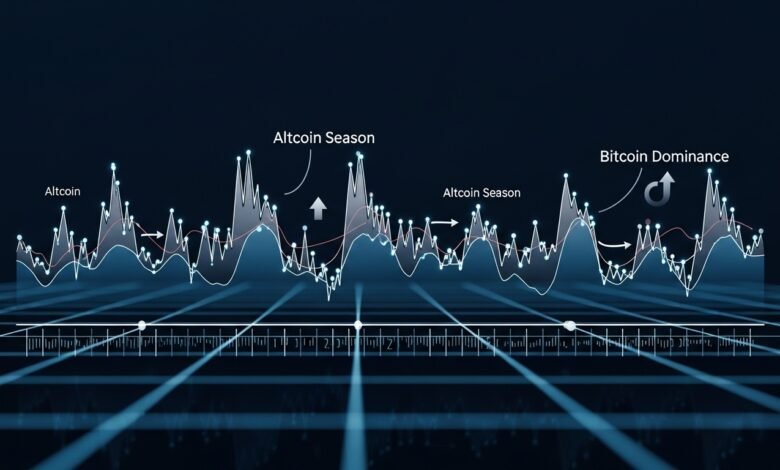

Crypto markets move in narratives, but the strongest narratives are usually backed by recognizable price behavior. Right now, traders and long-term investors alike are talking about one theme: altcoin season pattern. It’s the idea that after Bitcoin leads a cycle, liquidity and attention rotate into large-cap altcoins, then into mid-caps, and eventually into smaller coins as risk appetite grows. The “season” label can sound trendy, yet it often reflects a repeatable rhythm of capital flow, sentiment, and technical breakout structures.

What’s making the conversation louder is a fresh chart circulating among analysts that suggests a massive upside framework—up to 184x potential—for major names like ETH, XRP, SOL, and ADA. While anyone can post a dramatic projection, the more interesting part is the “pattern” logic behind it: how historical cycles have formed similar bases, how breakouts have unfolded in stages, and how altcoins tend to accelerate once certain market conditions align. This doesn’t mean prices must follow a script, but markets frequently rhyme. When a recognizable altcoin season pattern emerges, it can offer a structured way to think about scenarios, risk, and timing.

In this article, you’ll get a clear, engaging, human-first breakdown of what an altcoin season pattern is, why these assets—Ethereum, XRP, Solana, and Cardano—are often at the center of the narrative, and how traders interpret a chart that highlights 184x potential. You’ll also learn how to approach these claims without getting trapped by hype. The goal is not blind optimism; it’s informed decision-making with context, probability, and disciplined strategy.

Altcoin Season Pattern

An altcoin season pattern typically refers to a period when altcoins outperform Bitcoin on a relative basis. This outperformance often comes after Bitcoin has already made significant gains and begins to consolidate, creating an environment where traders seek higher beta returns elsewhere. At that point, capital rotates into Ethereum first, then spreads to other large-cap altcoins like XRP, SOL, and ADA. If momentum continues, the market broadens to mid-cap and small-cap projects, and “everything pumps” becomes a familiar phrase.

The reason this pattern tends to repeat is structural. Bitcoin is the most liquid and widely recognized crypto asset, so it often serves as the initial risk-on gateway. Once investors feel confident the cycle has legs, they move along the risk curve. Ethereum, due to its dominant ecosystem and deep liquidity, often becomes the next stop. If ETH leads, it can act like a signal flare that the market is comfortable reaching for returns in altcoins, and that’s when the altcoin season pattern can begin to look obvious in charts and performance metrics.

The Role of Market Psychology in Altcoin Season

Market cycles are partly math and mostly human nature. When Bitcoin rallies, it attracts attention and conviction. After the first leg, late entrants look for “the next Bitcoin,” and that’s where the altcoin season pattern can ignite. Social sentiment rises, influencers amplify price targets, and retail interest returns. That combination can create reflexive loops: rising prices attract buyers, which raises prices further, which attracts even more buyers. It’s not always healthy, but it’s real.

However, psychology works both ways. When leverage is high and expectations become extreme, volatility increases. That’s why understanding the altcoin season pattern matters: it’s not just about chasing pumps, but about recognizing phases—accumulation, breakout, expansion, and eventual cooling—so you can keep decisions grounded.

Why a “Fresh Chart” Can Spark Big 184x Narratives

Whenever the market shifts from fear to optimism, charts become storytelling devices. A fresh chart can gain traction because it compresses a complex market into a simple visual: a base, a breakout line, and a projected move. The “184x potential” claim is usually derived from comparing previous cycle expansions to current consolidation ranges or by applying measured-move frameworks from long-term logarithmic charts. In other words, it’s often not a random number—it’s a multiplier pulled from historical amplitude.

Still, a projection is not a promise. A chart that highlights 184x potential might be based on a prior cycle where a coin did extraordinary multiples from a deep bear market low. But the larger and more mature an asset becomes, the harder it is to repeat the same magnitude of returns. This is why it’s essential to treat such charts as scenario tools, not destiny.

Multipliers vs. Market Cap Reality

One reason traders debate “184x potential” is market cap. A coin doing 184x from today’s valuation could imply a total market cap that competes with or exceeds major global asset classes. That doesn’t make it impossible, but it does raise the bar. When you see altcoin season pattern projections, it helps to ask: is the starting point a true cycle low, or a mid-cycle level? Is the chart using a long time horizon, or a short speculative window? Is it comparing the same phase of the cycle?

These questions don’t ruin the bullish thesis; they refine it. The strongest approach is to keep multiple scenarios: conservative, base case, and aggressive. That way, even if the 184x potential is an edge-case outcome, you can still benefit from more realistic moves without being emotionally anchored to moon numbers.

Ethereum (ETH): The Centerpiece of Many Altcoin Season Patterns

Ethereum tends to be the heart of the altcoin season pattern for a simple reason: it often functions as the liquidity bridge between Bitcoin and the broader altcoin market. ETH is deeply integrated into DeFi, staking, NFTs (even if that narrative is quieter), and token issuance. When ETH begins to outperform Bitcoin, many traders interpret it as an early sign that the altcoin season pattern is forming.

From a technical perspective, Ethereum often spends long periods building a base during uncertain market phases. When momentum returns, ETH can break resistance levels that have capped price for months. Those breakouts can then spill over into other Layer-1s and large-cap altcoins as capital rotates.

What ETH Bulls Watch During an Altcoin Season Pattern

In altcoin season discussions, analysts often highlight ETH price targets and long-term resistance zones. They look for a clean reclaim of major moving averages, strong weekly closes above multi-month ranges, and sustained volume. The most convincing altcoin season pattern signals often include Ethereum strength paired with stable Bitcoin dominance or a gradual decline in dominance as altcoins capture market share.

The “184x potential” narrative, when applied to ETH, is usually less about literal 184x from current prices and more about the broader concept that the cycle could deliver outsized returns across the altcoin complex. Ethereum’s role is to lead, not necessarily to do the craziest multiple.

XRP: A High-Volatility Candidate in the Altcoin Season Pattern

XRP often behaves differently from many altcoins because its narrative is tied heavily to adoption, partnerships, and regulatory clarity. That said, in a true altcoin season pattern, XRP has historically shown an ability to move sharply when sentiment flips bullish. It can lag for long periods, then suddenly surge as liquidity floods into large-cap names with strong brand recognition.

The attraction to XRP in an altcoin season context is its tendency to form long consolidation ranges. Traders love long ranges because they can set clean invalidation levels. When a breakout occurs, it can feel explosive because so many participants have been waiting, watching, and positioning.

XRP Price Structures That Fuel Big Projections

When charts suggest massive upside for XRP, they often rely on multi-year accumulation patterns. These patterns can resemble compression coils where volatility tightens until price breaks out. In an altcoin season pattern, XRP’s breakout can be amplified if it coincides with broader market euphoria and renewed attention on high-liquidity “legacy altcoins.”

To stay grounded, it’s useful to track whether XRP’s moves are supported by volume expansion and whether breakouts hold on retests. Many fake-outs occur when hype outruns actual demand. The healthier the structure, the more durable the trend.

Solana (SOL): Momentum, Ecosystem, and the Altcoin Season Pattern

Solana is frequently highlighted as a key beneficiary when the altcoin season pattern shifts toward high-momentum ecosystems. SOL has built a reputation for speed, user activity, and an expanding set of applications. In bull phases, markets often reward coins that have both narrative energy and visible ecosystem traction, and SOL tends to attract both.

In an altcoin season environment, Solana can exhibit strong trend persistence. When it breaks out of a base, it often runs in waves—impulse moves followed by controlled pullbacks—especially when the broader market is risk-on. Traders tend to watch Solana because it can become a sentiment bellwether: if SOL is ripping, it usually means traders are willing to take on more risk.

SOL Price Scenarios and the “Fresh Chart” Effect

The fresh chart highlighting major upside for SOL typically uses prior cycle behavior or strong historical rebounds as reference. Solana has experienced dramatic drawdowns and equally dramatic recoveries, which makes it fertile ground for large-multiple narratives. When a chart suggests “184x potential,” it’s often using an extreme low as the base. For most investors, the practical takeaway is not that SOL must do 184x, but that strong cycles can produce outsized returns in top-performing Layer-1s during the peak of the altcoin season pattern.

The best way to interpret these scenarios is to map key levels: support zones where buyers historically stepped in, resistance levels that represent supply, and trend confirmation areas that help avoid buying into late-stage spikes.

Cardano (ADA): Patience, Cycles, and Altcoin Season Dynamics

Cardano tends to attract a particular style of investor—one that emphasizes long-term development, research-driven narratives, and structured roadmaps. In a strong altcoin season pattern, ADA has historically shown the ability to awaken after long quiet stretches. That “slow then sudden” behavior is part of why ADA appears in many bullish cycle charts.

ADA often forms extended accumulation ranges. When the market turns risk-on, these ranges can break to the upside as sidelined capital rotates into recognizable large caps. Cardano also benefits from being one of the most widely held altcoins, which means it can catch broad retail attention when the market heats up.

ADA Price Targets Without the Hype Trap

ADA’s most credible bullish outlooks focus on reclaiming major historical levels and building higher lows. If a “184x potential” chart includes ADA, it likely references a cycle low baseline, then applies a peak-cycle expansion ratio. For most participants, the smarter approach is to think in tiers: early-cycle moves, mid-cycle continuation, and late-cycle blow-off risk. The altcoin season pattern often ends with volatility spikes, and ADA is not immune to that.

The goal is to participate without getting emotionally attached to a single number. In crypto, it’s not the highest target that matters; it’s whether your plan handles both upside and downside.

Key Signals That an Altcoin Season Pattern Is Actually Emerging

The biggest mistake people make is declaring altcoin season too early. A genuine altcoin season pattern tends to show multiple confirmations across market structure, relative strength, and sentiment. One common signal is Ethereum outperforming Bitcoin over a sustained period. Another is a decline in Bitcoin dominance alongside rising total crypto market cap.

Altcoin season also tends to show breadth. It’s not just one coin pumping; it’s many high-quality large caps moving together with improving market liquidity. When breadth expands, it becomes easier for narratives like “184x potential” to spread, because traders see evidence of a broad-based regime change rather than isolated speculation.

Liquidity Rotation and Risk Curves

Liquidity rotation is the engine behind the altcoin season pattern. It often starts with Bitcoin strength, then ETH strength, then large caps like XRP, SOL, and ADA, and eventually moves into smaller assets. When that rotation is healthy, pullbacks tend to be bought, and dips become shorter. When rotation is unhealthy, pumps are sharp, dumps are sharper, and trend structure fails quickly. If you want to spot altcoin season early, watch whether capital keeps cycling rather than vanishing after each spike. Persistent rotation suggests a market that’s building energy, not burning out.

How to Approach 184x Potential Claims Like a Pro

Massive upside projections are exciting, but the best investors treat them as optionality, not certainty. If a chart highlights 184x potential, it’s often describing a tail-risk bullish outcome in a powerful cycle. The professional move is to translate that into a plan that works across scenarios. A grounded approach to the altcoin season pattern involves defining entries, invalidation points, profit-taking rules, and position sizing. Without those, even a correct directional call can turn into a loss because emotional decisions take over. The market doesn’t punish optimism; it punishes poor risk management.

Time Horizon Matters More Than Targets

Another overlooked factor is time. Even if the market eventually fulfills a bullish cycle, it might do so after brutal drawdowns and frustrating consolidations. If your time horizon is short, you may get shaken out before the move happens. If your time horizon is long, you still need a strategy for volatility. The altcoin season pattern can be profitable, but it rarely feels comfortable in real time.

When you see bold targets for ETH, XRP, SOL, and ADA, shift your focus from “How high can it go?” to “What would confirm the trend, and what would invalidate it?” That mindset keeps you rational even when social media is screaming moon.

Conclusion

The renewed attention on altcoin season pattern makes sense. Crypto cycles often rotate in recognizable phases, and large-cap altcoins like Ethereum, XRP, Solana, and Cardano tend to be central players when liquidity broadens. A fresh chart highlighting 184x potential might be dramatic, but it also reflects a real market truth: in strong cycles, crypto can deliver extreme moves that are rare in traditional markets.

Still, the smartest way to engage with the altcoin season pattern is to balance optimism with structure. Use the pattern as a map—watch confirmations, understand rotation, and respect invalidation levels. If the market delivers a powerful expansion, you’ll be positioned. If it doesn’t, you’ll still have capital and clarity for the next opportunity.

FAQs

Q: What is an altcoin season pattern in simple terms?

An altcoin season pattern is a period when altcoins collectively outperform Bitcoin, often after Bitcoin has already rallied and begins to consolidate, allowing capital to rotate into altcoins.

Q: Does Ethereum always lead the altcoin season pattern?

Ethereum often plays a leading role because of its liquidity and ecosystem influence, but it doesn’t “always” lead. However, sustained ETH strength versus BTC is commonly viewed as a key altcoin season pattern confirmation.

Q: Are 184x potential price projections realistic for ETH, XRP, SOL, and ADA?

They can be possible only under extreme bullish conditions and usually depend on using cycle lows as the starting point. Most investors treat “184x potential” as a high-end scenario rather than a base-case expectation.

Q: What’s the biggest risk during altcoin season?

The biggest risk is volatility and late-cycle euphoria. During an altcoin season pattern, prices can rise fast but also crash quickly, especially when leverage and hype dominate decision-making.

Q: How can I tell if altcoin season is ending?

Signs include weakening breadth, failed breakouts, sharp dominance shifts back to Bitcoin, and rising sell-offs on high volume. When the pattern breaks, rallies tend to fade faster and support levels fail more often.