ARK Invest Files for CoinDesk 20 Crypto Index ETFs

ARK Invest files for CoinDesk 20 Crypto Index ETFs, signaling a major step toward diversified crypto investing. Explore structure, impact, risks, and outlook.

ARK Invest has long positioned itself at the intersection of innovation and emerging technology, and its growing involvement in digital assets reflects that philosophy. The news that ARK Invest files for CoinDesk 20 Crypto Index ETFs marks another pivotal moment in the evolution of crypto investing, especially within regulated financial markets. This move signals a shift away from single-asset exposure toward broader, index-based strategies that mirror how traditional equity markets matured over time.

For years, institutional and retail investors alike have struggled with one core challenge in crypto: diversification. While bitcoin and ethereum have dominated headlines and portfolios, the broader crypto ecosystem now spans multiple large-cap networks with different use cases, technologies, and risk profiles. The CoinDesk 20 index was designed to capture that wider market, and ARK’s decision to pursue ETFs linked to it reflects growing demand for simplified, diversified crypto exposure.

At its core, the conversation around ARK Invest files for CoinDesk 20 Crypto Index ETFs is about accessibility. These ETFs aim to provide exposure to major digital assets without requiring investors to manage private keys, wallets, or multiple exchanges. At the same time, they raise important questions about structure, tracking accuracy, fees, and long-term performance. Understanding what these ETFs represent—and what they do not—is essential for anyone following the future of crypto markets.

Understanding the CoinDesk 20 Crypto Index

The CoinDesk 20 Crypto Index was created to function as a broad benchmark for the digital asset market. Much like major stock indices track large-cap equities, this index focuses on leading cryptocurrencies while excluding categories that may distort performance, such as stablecoins or highly speculative tokens.

How the CoinDesk 20 index is structured

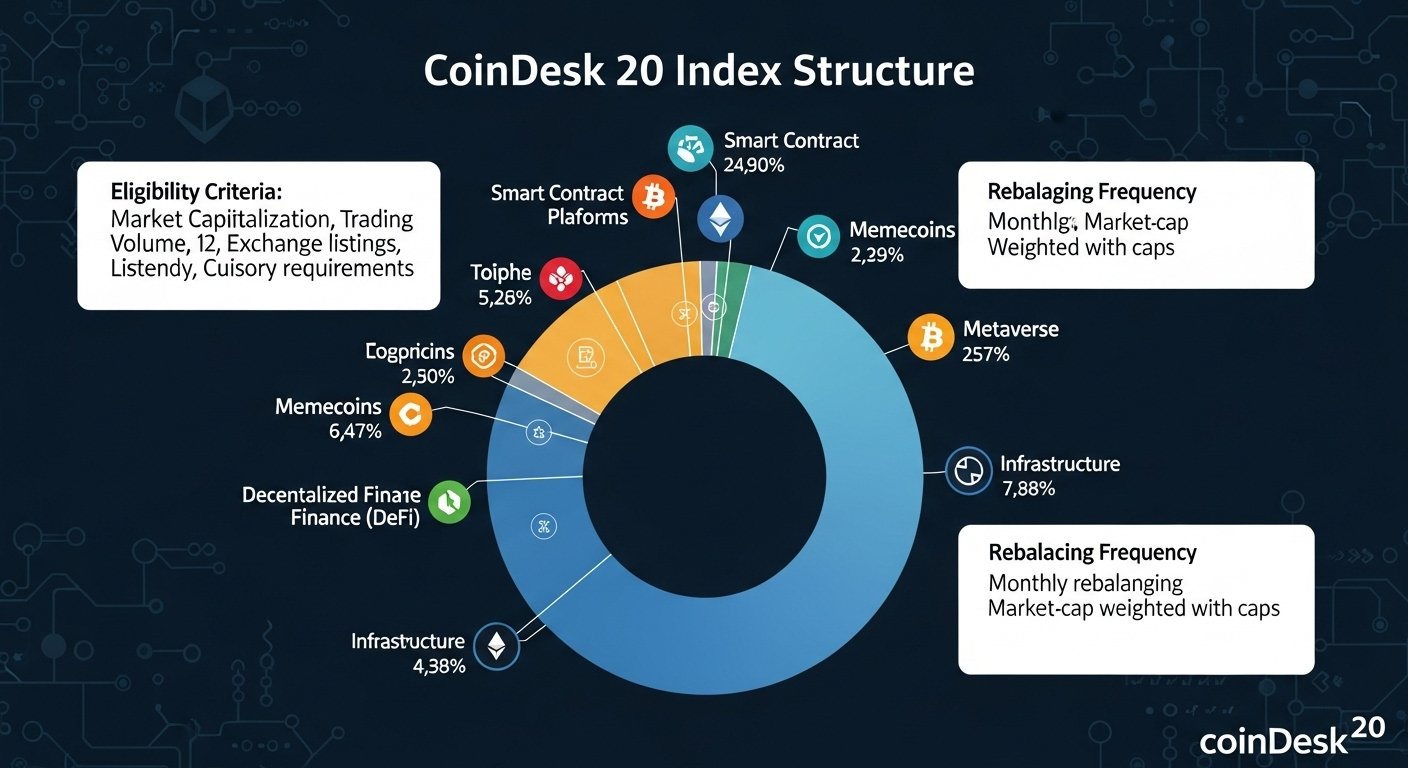

The index typically includes the twenty largest eligible digital assets based on market capitalization and liquidity criteria. Weighting is generally market-cap based but capped to prevent excessive concentration in a single asset. This design helps balance representation while maintaining investability.

By applying consistent eligibility rules, the index aims to remain stable, transparent, and suitable for financial products. This structure is particularly important for ETFs, which must rebalance predictably and track their benchmark without excessive turnover or operational friction.

Why the CoinDesk 20 matters in crypto investing

The CoinDesk 20 index represents a shift toward maturity in the crypto market. Rather than focusing on individual narratives or speculative trends, it offers a snapshot of the broader large-cap crypto ecosystem. This makes it attractive to investors who want market-level exposure instead of betting on a single project.

As more institutional products are built around this benchmark, CoinDesk 20 Crypto Index ETFs could become a reference point for performance comparisons, portfolio construction, and asset allocation strategies.

Why ARK Invest filing for CoinDesk 20 Crypto Index ETFs is significant

When a firm like ARK Invest takes action, markets pay attention. ARK is known for thematic investing and for backing disruptive technologies before they become mainstream. Its decision to file for CoinDesk 20 Crypto Index ETFs suggests confidence in both the index and the long-term role of crypto within diversified portfolios.

A move beyond single-asset crypto ETFs

Until recently, most regulated crypto ETFs focused on one asset—typically bitcoin, and later ethereum. While these products opened the door to crypto exposure, they also concentrated risk. The fact that ARK Invest files for CoinDesk 20 Crypto Index ETFs indicates a belief that investors are ready for broader exposure.

Index-based ETFs offer diversification across multiple assets, reducing reliance on the performance of any single cryptocurrency. This mirrors how equity investors moved from individual stock picking to index funds as markets matured.

Two ETF variations, two investment strategies

ARK’s filings reportedly include two variations: one that tracks the full CoinDesk 20 index and another that excludes bitcoin. This distinction is important.

The full index ETF targets investors who want comprehensive market exposure, including bitcoin’s dominant role. The ex-bitcoin version, on the other hand, appeals to investors who already hold bitcoin separately or who want greater exposure to large-cap altcoins without increasing bitcoin concentration.

How CoinDesk 20 Crypto Index ETFs are expected to work

To evaluate any ETF, investors must look beyond the name and examine the mechanics. CoinDesk 20 Crypto Index ETFs are not necessarily designed to hold each cryptocurrency directly.

Futures-based exposure explained

The proposed structure relies primarily on futures contracts and related instruments rather than direct ownership of digital assets. This approach can simplify custody and regulatory compliance, but it introduces additional variables into performance.

Futures-based ETFs may experience tracking differences compared to spot prices, especially during periods of market stress or when futures markets are in contango or backwardation. Over time, these effects can influence returns in ways that differ from holding the underlying assets.

Collateral, cash holdings, and performance tracking

In a futures-based structure, the ETF typically holds cash or cash equivalents as collateral while maintaining exposure through derivatives. The fund’s performance depends on how effectively these instruments replicate the index’s returns.

For investors, this means CoinDesk 20 Crypto Index ETFs may not move in perfect lockstep with the spot market. Understanding this distinction is critical when setting expectations.

The appeal of diversified crypto exposure

Diversification is one of the most compelling arguments for index-based investing, and crypto is no exception.

Reducing single-asset risk

Crypto markets are notoriously volatile. Individual assets can experience dramatic price swings due to regulatory news, technological issues, or shifts in investor sentiment. By spreading exposure across multiple large-cap assets, CoinDesk 20 Crypto Index ETFs aim to reduce the impact of any single event.

While diversification does not eliminate risk, it can help smooth returns over time and reduce dependence on one dominant narrative.

Simplifying portfolio construction

For investors who want crypto exposure but lack the time or expertise to manage multiple positions, an index ETF offers simplicity. Instead of deciding how much to allocate to each asset, investors gain exposure through a single product that automatically rebalances according to index rules.

This convenience is one of the key reasons CoinDesk 20 Crypto Index ETFs are gaining attention.

Risks and limitations investors should consider

Despite their appeal, these ETFs are not without drawbacks.

Tracking error and roll costs

Futures-based ETFs can suffer from tracking error, especially over longer holding periods. Rolling futures contracts can introduce costs that gradually erode returns, particularly in volatile or trending markets.

Investors expecting spot-like performance may be surprised by these differences.

Market correlation during downturns

Although the CoinDesk 20 index includes multiple assets, crypto markets often become highly correlated during major sell-offs. In such scenarios, diversification benefits may be limited, and the ETF could still experience sharp declines.

Regulatory and structural uncertainty

Crypto regulation continues to evolve. Changes in regulatory guidance, futures market rules, or ETF compliance requirements could affect how CoinDesk 20 Crypto Index ETFs operate in the future.

How this move fits into the broader crypto ETF landscape

The filing by ARK Invest reflects a broader trend toward index-based crypto products.

Growing competition among crypto ETF issuers

As more firms explore diversified crypto ETFs, competition is likely to increase. This could lead to lower fees, improved structures, and greater transparency over time.

For investors, competition generally results in better products—but it also means careful comparison is essential.

Normalizing crypto in traditional portfolios

Index ETFs play a critical role in integrating new asset classes into mainstream investing. CoinDesk 20 Crypto Index ETFs could help position crypto as a standard portfolio allocation rather than a speculative outlier.

This normalization may encourage wider adoption among financial advisors and long-term investors.

Who should consider CoinDesk 20 Crypto Index ETFs

These ETFs are not designed for every investor.

Ideal for long-term, diversified exposure seekers

Investors who want broad crypto exposure without managing individual assets may find CoinDesk 20 Crypto Index ETFs appealing. They are particularly suitable for those comfortable with derivatives-based structures and long-term holding periods.

Less suitable for active traders or purists

Active traders who want precise exposure or investors who value direct ownership, staking, or on-chain participation may prefer alternative approaches.

Conclusion

The announcement that ARK Invest files for CoinDesk 20 Crypto Index ETFs represents a meaningful step in the evolution of crypto investing. It reflects growing demand for diversified, index-based exposure and signals increasing confidence in crypto as a long-term asset class.

While these ETFs offer convenience and broad market access, they also come with structural complexities that investors must understand. Futures-based tracking, potential tracking error, and regulatory considerations all play a role in determining real-world performance.

As the crypto ETF landscape continues to evolve, CoinDesk 20 Crypto Index ETFs may become an important bridge between traditional finance and the digital asset economy. Investors who take the time to understand how these products work will be best positioned to decide whether they belong in their portfolios.

FAQs

Q: What does it mean when ARK Invest files for CoinDesk 20 Crypto Index ETFs?

It means ARK Invest has formally submitted ETF registration documents seeking approval to offer funds that track the CoinDesk 20 index or a variation of it.

Q: What is included in the CoinDesk 20 Crypto Index?

The index generally includes twenty large-cap digital assets that meet specific liquidity and eligibility criteria, excluding stablecoins and certain other categories.

Q: Are CoinDesk 20 Crypto Index ETFs spot-based?

They are designed primarily as futures-based ETFs, meaning they track the index using derivatives rather than holding the underlying cryptocurrencies directly.

Q: What is the difference between a full CoinDesk 20 ETF and an ex-bitcoin version?

The ex-bitcoin version removes bitcoin exposure, allowing investors to focus on large-cap altcoins while managing bitcoin exposure separately.

Q: Are CoinDesk 20 Crypto Index ETFs suitable for beginners?

They can be suitable for beginners seeking diversified exposure, but investors should understand futures-based structures and associated risks before investing.