Bitcoin Price Oct 10 Liquidations Still Weigh

Bitcoin price faces pressure from the Oct 10 liquidation overhang as analysts track derivatives, demand signals, and the path toward $70,000.

Bitcoin has a way of turning one dramatic day into weeks of aftershocks. The October 10 liquidation event was one of those moments—a rapid, forceful unwind in leveraged positions that didn’t just move the chart for a few hours, but altered trader behavior, liquidity conditions, and market psychology long after the initial cascade ended. Even as bitcoin attempts to reclaim momentum, the lingering impact of that flush continues to act like gravity on bitcoin’s price, limiting follow-through rallies and making every push upward feel harder-earned.

What makes liquidation events so influential isn’t only the price drop during the episode. It’s the structural damage they can leave behind: reduced risk appetite, thinner order books, cautious market makers, and a derivatives market that takes time to rebuild healthy positioning. Add in the fact that bitcoin is now heavily traded across perpetual futures, options, and automated liquidity venues, and you get a market where forced selling can echo. Analysts watching the road back to the $70,000 level aren’t just tracking headlines—they’re monitoring the invisible plumbing: funding rates, open interest, liquidity clusters, and whether demand from spot buyers is strong enough to absorb renewed supply.

This article breaks down why the October 10 liquidation overhang still matters, what analysts are looking at when they talk about $70,000, and how traders and long-term investors can interpret the next major signals without getting caught in the noise. Along the way, you’ll see how crypto market mechanics—especially BTC liquidation dynamics—can shape bitcoin price action in ways that aren’t always obvious on a simple candlestick chart.

Why the October 10 liquidation event still matters for bitcoin price

Liquidations are not “normal selling.” They are forced transactions triggered by margin requirements, usually executed at market prices in a fast-moving environment. When the October 10 liquidation event hit, many traders who were long on leverage were pushed out simultaneously, and the market had to absorb that supply immediately. In a highly connected derivatives ecosystem, that pressure can spread quickly—one wave of liquidations triggers price drops, which triggers more liquidations, and so on.

The reason this continues to weigh on bitcoin’s price is that the aftermath often changes the market’s posture. Traders who were burned become conservative, reducing risk and avoiding aggressive longs. Market makers may widen spreads because volatility risk increases. Even spot participants—who might otherwise buy dips—can hesitate when they sense unstable conditions. The result is a market that can rally, but struggles to sustain rallies.

Another key factor is how liquidation events reshape positioning. After a cascade, the market frequently rebuilds leverage in a cautious way. If leverage returns too quickly, any upside move can be capped by profit-taking or hedging. If leverage returns slowly, price can grind, but it may lack the energy needed to break major resistance. In both cases, the liquidation “memory” remains embedded in behavior and flows, which is why analysts keep referencing October 10 when discussing bitcoin price strength.

The mechanics of liquidation overhang in the crypto market

A liquidation event is often described as a single moment, but the overhang is a process. After the initial flush, the market goes through a stabilization phase where participants recalibrate. This is where the weight shows up: bitcoin may bounce, but repeated attempts to break higher levels fail because liquidity is uneven and confidence is fragile.

How forced selling distorts price discovery

In a healthy market, price discovery is driven by willing buyers and willing sellers. During a liquidation cascade, selling is not “willing”—it’s automatic. That creates temporary mispricing, slippage, and sharp wicks that can invalidate technical levels. Once that happens, traders become skeptical about signals. A resistance line that “should” break might not, because participants don’t trust the follow-through.

This distortion matters for bitcoin price because technical traders and algorithmic systems feed on patterns. When patterns break due to forced selling, the market may shift into a choppy regime. That chop is the overhang: a period where bitcoin moves, but struggles to trend cleanly.

Liquidity gaps and thinner order books after a cascade

One of the most underappreciated impacts of a major BTC liquidation event is the liquidity damage it can cause. In volatile conditions, market makers often pull orders or reduce size. When that happens, the order book develops gaps—price levels where there simply aren’t enough resting bids to support a clean move.

If bitcoin starts rallying toward a major level like $70,000, thin liquidity can paradoxically make it harder to climb. Why? Because big buyers need depth. Without depth, they can’t accumulate without moving the market against themselves, so they either slow down or wait for better conditions. This is why analysts watch order book liquidity and market depth in addition to basic chart patterns.

Analysts’ focus on $70,000: why this level matters now

Round-number levels matter in every market, but bitcoin is especially sensitive to them because of the way retail interest, media narratives, and derivatives positioning concentrate around major figures. The $70,000 level is more than a psychological milestone—it’s a magnet for liquidity, options strikes, and trader expectations.

When analysts say they’re “eyeing $70,000,” they are often implying a test of whether bitcoin price can transition from recovery mode into expansion mode. If bitcoin can reclaim and hold that zone with strong demand, it suggests the market has absorbed the liquidation overhang and rebuilt confidence. If it fails repeatedly, it implies the October 10 event still has unresolved consequences in positioning and sentiment.

The role of options strikes and hedging flows

In crypto derivatives, options strikes near major levels tend to attract heavy open interest. That can create hedging flows that influence price behavior. As bitcoin approaches a level with concentrated options exposure, dealers may hedge dynamically, which can either dampen volatility or amplify it depending on positioning.

This is why bitcoin price can sometimes “stall” below a big round number. It’s not always a lack of interest—it can be the result of hedging mechanics and derivatives market structure. After a liquidation event, these effects can be more pronounced because participants are already cautious and quick to hedge.

Why reclaiming $70,000 could shift sentiment

Bitcoin is a narrative-driven asset. A reclaim of $70,000 can change the tone quickly, attracting sidelined capital and increasing participation. But for that shift to last, the move has to look stable—strong spot demand, manageable funding, and no immediate signs of overheating leverage.

Analysts often describe this as bitcoin needing “clean acceptance” above a key level. That means price doesn’t just tap the number; it holds it, retests it, and builds support. Without that process, the market risks another sharp rejection, which would reinforce the post-liquidation caution that has weighed on bitcoin’s price.

Derivatives signals analysts are watching after October 10

Because the October 10 liquidation event was fundamentally a leverage unwind, derivatives metrics have become central to interpreting bitcoin price action. These indicators help answer one question: is the market rebuilding in a healthy way, or setting up for another forced move?

Funding rates and leverage temperature

Funding rates in perpetual futures are one of the fastest ways to gauge leverage bias. When funding is strongly positive, it often means longs are paying shorts—suggesting crowded bullish positioning. After a liquidation cascade, funding can snap negative, then slowly normalize.

Analysts tend to prefer moderate, stable funding when bitcoin is trying to climb. If bitcoin price rises while funding stays reasonable, it suggests spot demand is driving the move. If bitcoin price rises and funding spikes, it can signal a leverage-led rally that is vulnerable to another shakeout.

Open interest and whether risk is rebuilding too fast

Open interest measures how many derivatives contracts are outstanding. A healthy recovery often shows open interest rebuilding gradually while price trends upward. A risky recovery can show open interest exploding quickly—meaning leverage is returning too aggressively.

After October 10, analysts are especially sensitive to this. A sudden surge in open interest near resistance levels can create a brittle market structure, where a small pullback triggers liquidations again. That’s one of the clearest ways the earlier liquidation event can remain a weight on bitcoin’s price: it makes the market hypersensitive to leverage rebuilds.

Liquidation heatmaps and liquidity clusters

Many traders track liquidation levels—zones where large amounts of leverage may be forced out if price reaches them. These liquidity clusters can act like targets, pulling price toward them during volatile periods.

If a large cluster sits above the current bitcoin price, markets can squeeze upward to trigger shorts. If a large cluster sits below, a dip can cascade into long liquidations. After a major event like October 10, these maps often show a market still littered with vulnerable positioning, which can keep bitcoin trading defensively.

Spot demand: the force that can overcome liquidation pressure

If liquidation overhang is the weight, spot demand is the engine that can lift bitcoin’s price anyway. Spot buying represents unleveraged conviction—capital that isn’t forced out by a margin call. For bitcoin to push convincingly toward $70,000, analysts generally want to see signs that spot buyers are in control.

The importance of real buyers over leverage

A leverage-led rally can look powerful but fade quickly. A spot-led rally tends to be slower but more durable. The difference often shows up in how bitcoin behaves during pullbacks. If dips are bought quickly without funding overheating, that suggests accumulation. If dips trigger panic and liquidations, that suggests fragile structure.

This distinction matters more after October 10 because the market has already demonstrated how quickly leverage can unwind. Analysts want to see bitcoin price supported by “real” demand, not just futures traders chasing momentum.

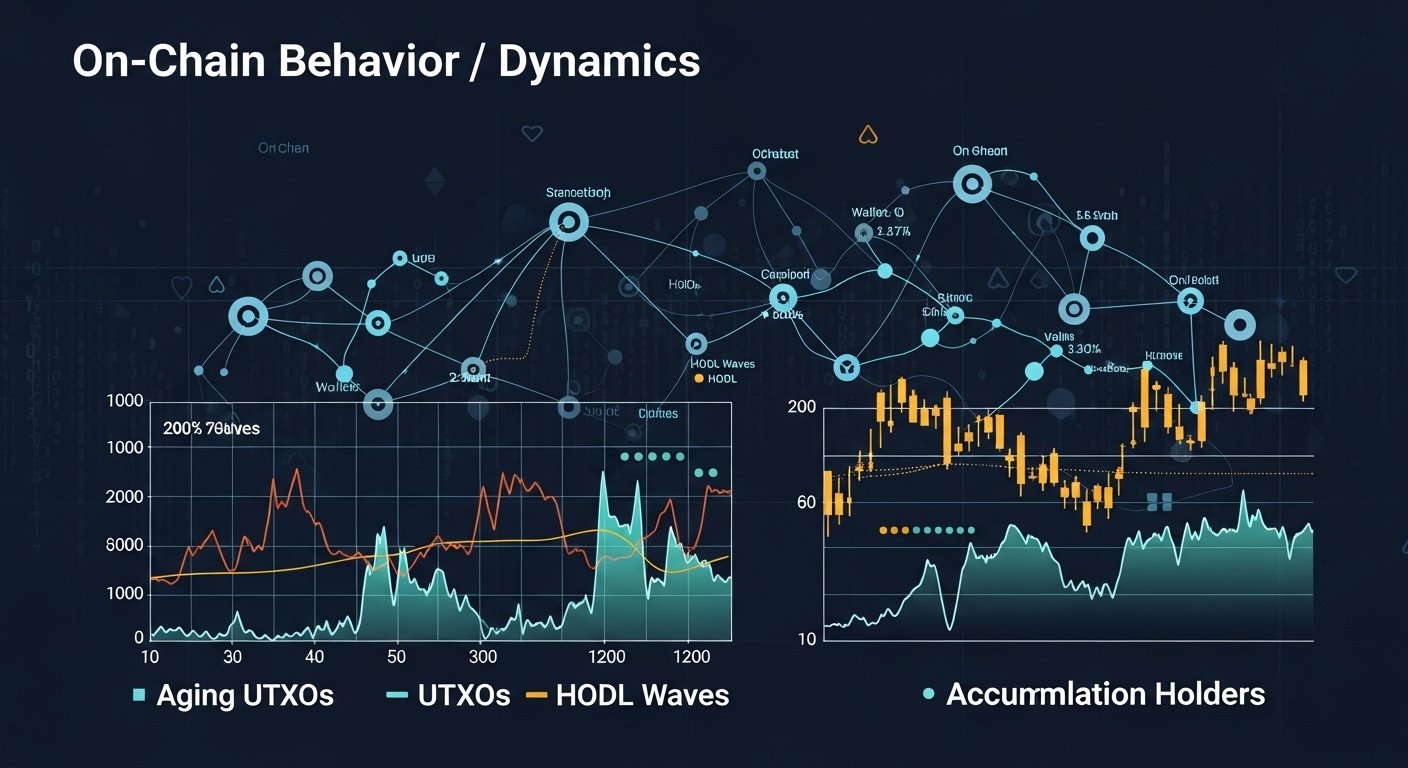

On-chain behavior and long-term holder dynamics

While on-chain indicators are not perfect, they can add context. Analysts often watch whether long-term holders are distributing into strength or holding through volatility. If long-term participants remain steady while short-term traders churn, it can imply the base is firming even if price feels heavy.

In periods following liquidation cascades, on-chain signals can help separate structural weakness from temporary noise. If long-term conviction remains intact, the liquidation event may be a reset rather than a lasting trend change—supportive for an eventual move back toward $70,000.

Macro and liquidity backdrop: why bitcoin can’t ignore the bigger picture

Bitcoin trades as both a unique asset and a macro-sensitive instrument. Broader liquidity conditions, interest rate expectations, and risk sentiment can influence whether bitcoin price can overcome internal market structure issues like liquidation overhang.

When global risk appetite is strong, bitcoin often benefits from capital looking for growth exposure. When risk appetite is weak, bitcoin can behave defensively, and liquidation-driven volatility becomes more damaging because buyers step back.

This is why analysts combine crypto-native signals with macro cues. If the macro environment supports risk-taking, a move toward $70,000 becomes more plausible. If macro conditions tighten, the October 10 liquidation event can remain a weight longer because the market lacks external fuel.

Technical structure: what needs to happen for bitcoin to reach $70,000

Technical analysis isn’t magic, but it reflects collective behavior. After a major liquidation event, the chart often develops key zones where supply repeatedly shows up and where buyers must prove strength.

Support zones that must hold during pullbacks

For bitcoin price to build toward $70,000, it typically needs to establish higher lows and defend support levels on dips. The quality of these bounces matters. Strong support behavior often includes quick recoveries, rising spot volume on rebounds, and stable derivatives conditions.

If supports fail too easily, it suggests the liquidation overhang is still influencing behavior. Traders remember how quickly price fell during October 10, so they’re more likely to sell early when supports wobble. That can create a self-fulfilling drag.

Resistance behavior and the “acceptance” test

Resistance zones matter most when they repeatedly reject price. Each rejection can drain momentum and reinforce caution. For bitcoin, the path toward $70,000 usually requires not just a single breakout, but sustained trade above intermediate resistance levels.

Analysts look for signs of acceptance: bitcoin price breaking above resistance, holding it on a retest, and then grinding higher without dramatic funding spikes. This behavior indicates the market is transitioning from fragile recovery into healthier expansion.

Scenarios analysts discuss: breakout, range, or another flush

Because the October 10 liquidation event remains part of the market’s recent memory, analysts often outline scenarios rather than making absolute predictions. Each scenario is shaped by the balance between spot demand and leverage behavior. In a breakout scenario, bitcoin price climbs steadily as spot demand absorbs supply, funding stays moderate, and open interest grows gradually. This would make a $70,000 test feel like a natural progression rather than a sudden squeeze.

In a range scenario, bitcoin remains choppy, with rallies capped by cautious sellers and dips supported by selective buyers. This is often the “liquidation overhang” regime, where the market is healing but not ready to trend. In a flush scenario, leverage rebuilds too quickly, the market becomes top-heavy, and a pullback triggers another liquidation wave. This scenario is exactly what traders fear after October 10, and it’s why analysts emphasize derivatives metrics when discussing the next big move.

How traders and investors can read the market without chasing noise

The easiest way to get lost in bitcoin is to overreact to every candle. After a liquidation event, volatility can remain elevated, and fake-outs become common. A more grounded approach focuses on structure and confirmation.

Watching bitcoin price alone can be misleading if you ignore crypto derivatives conditions. A rally with overheated funding can be weaker than a slower rally with strong spot demand. Similarly, a dip isn’t automatically bearish if it clears fragile leverage and rebounds quickly.

For longer-term investors, the key is understanding that liquidation events often reset positioning rather than define the entire trend. The October 10 liquidation event can be a weight, but it can also clear excess and set the stage for a healthier climb—especially if bitcoin regains stability and demand strengthens.

Conclusion

The October 10 liquidation event didn’t just create a dramatic move; it reshaped the market’s internal structure. The lingering weight on bitcoin’s price comes from cautious positioning, thinner liquidity, and a derivatives ecosystem that takes time to rebuild in a stable way. As analysts eye the $70,000 level, the real story is whether bitcoin can transition from a post-liquidation recovery into a spot-driven advance—one supported by healthy funding, controlled open interest, and steady demand.

If bitcoin price can reclaim key resistance zones without leverage overheating, the path to $70,000 becomes more credible. If leverage returns too fast and volatility spikes, the liquidation overhang may continue to cap rallies and increase the risk of another sharp reset. In the end, the market will reveal its strength not through bold predictions, but through the quieter signals: how it behaves on pullbacks, how derivatives metrics evolve, and whether real buyers step in consistently.

FAQs

Q: What was the October 10 liquidation event in bitcoin?

It refers to a sharp, forced unwind of leveraged positions that triggered rapid selling and volatility. Because liquidations are automatic and market-driven, they can create cascading moves that affect bitcoin price structure for weeks.

Q: Why do liquidation events keep affecting bitcoin price afterward?

They can damage liquidity, reduce risk appetite, and change trader behavior. After a cascade, markets often become choppier, leverage rebuilds cautiously, and confidence takes time to recover—keeping bitcoin’s price under pressure.

Q: Why is $70,000 such an important bitcoin price level?

It’s a major psychological threshold and often a zone where derivatives exposure concentrates. Around such levels, hedging flows, profit-taking, and heightened attention can influence whether bitcoin breaks out or stalls.

Q: Which indicators do analysts watch after a liquidation cascade?

Commonly tracked metrics include funding rates, open interest, liquidation clusters, and signs of spot demand strength. These help determine whether a rally is sustainable or leverage-driven and fragile.

Q: What could help bitcoin overcome the liquidation overhang and reach $70,000?

A steady spot-led uptrend with moderate funding, gradual open interest growth, and strong support behavior on pullbacks can rebuild market stability. If those conditions align, bitcoin price has a clearer foundation to challenge $70,000.