Uniswap on X Layer Low-Cost DeFi, Deep Liquidity

DeFi world has entered an era where users no longer ask whether decentralized finance works—they ask where it works best. They want

DeFi world has entered an era where users no longer ask whether decentralized finance works—they ask where it works best. They want lower costs, faster confirmations, familiar tools, and prices that don’t collapse into slippage the moment they try to trade a meaningful size. That’s why the launch of Uniswap on X Layer of OKX matters: it combines a widely trusted swapping and liquidity engine with a network environment built to make on-chain activity more affordable and smooth.

For many users, the biggest barrier to consistent DeFi participation has never been a lack of interest. It’s friction. Transaction fees can turn small swaps into expensive experiments. Managing liquidity positions can feel like a luxury reserved for large portfolios. Even routine actions—approving tokens, adjusting strategies, moving between apps—can add up until the experience becomes tiring. The promise of Uniswap on X Layer is a more practical DeFi loop: swap, provide liquidity, and interact with applications in a way that feels sustainable, not sporadic.

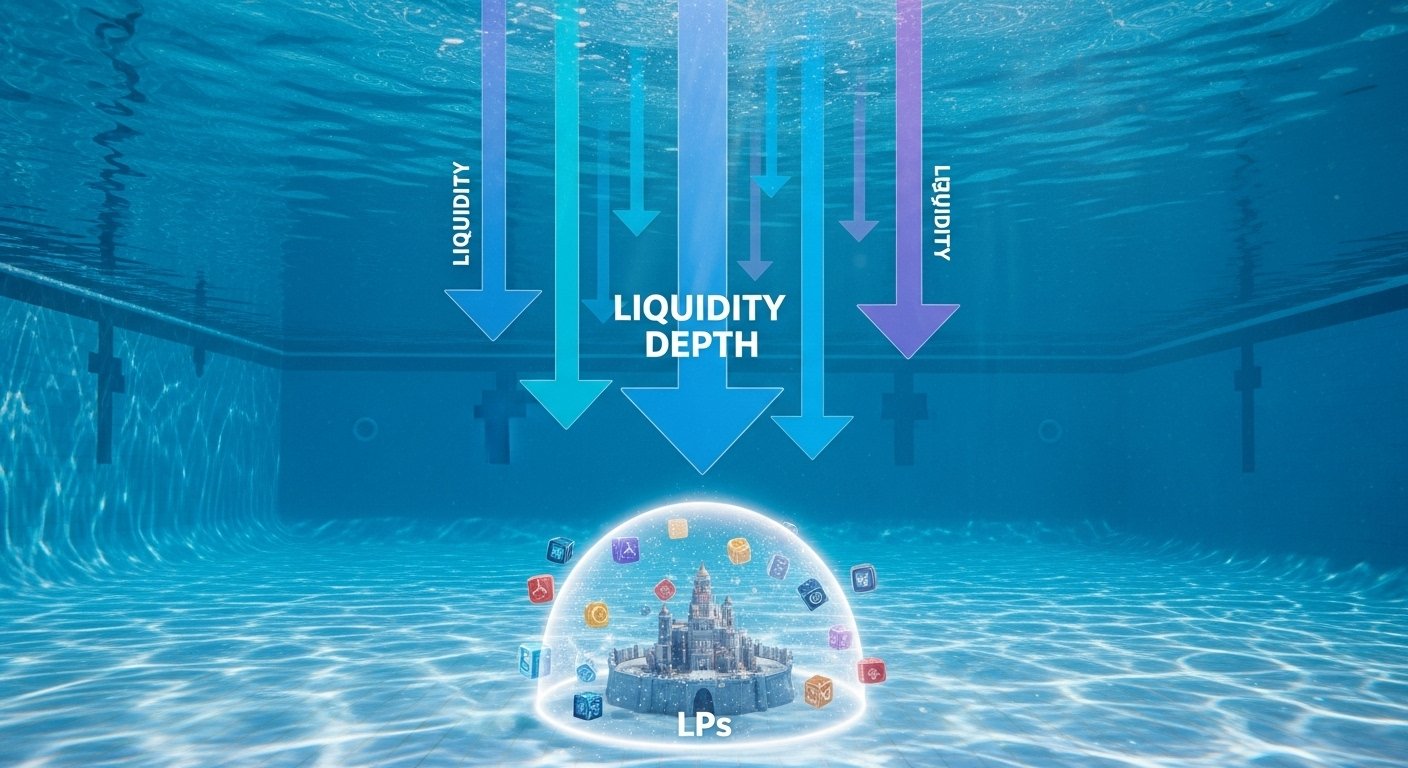

But “cheaper fees” alone don’t guarantee a good experience. DeFi is ultimately a marketplace, and marketplaces depend on liquidity depth, competitive pricing, and reliable execution. That’s where Uniswap’s design and network effects come into play. When people talk about deep liquidity, they’re talking about more than total value locked. They mean tighter pricing, reduced slippage, more efficient routes, and an ecosystem where trades can clear without dramatic price impact. In other words, cost-efficient access becomes truly valuable only when it is paired with execution quality.

This article explains what it means that Uniswap on X Layer is live, why X Layer’s structure is built for cost-efficient DeFi access, how liquidity depth changes the quality of swaps, and what traders, liquidity providers, and developers can do to take advantage of this expansion. Along the way, we’ll also explore how this move fits into the bigger shift toward Layer 2 scaling, and why the best DeFi experiences increasingly come from combining low-cost infrastructure with proven market primitives.

Understanding the Launch: What “Uniswap on X Layer” Really Means

When a major DeFi protocol expands to a new network, the headline is often simple: “it’s deployed.” But the real impact depends on what is actually available to users and builders. Uniswap on X Layer goes beyond a quiet contract deployment because the experience is designed to be reachable from multiple surfaces. That matters because liquidity grows when users can access it easily, and when developers can route flow into it without rebuilding everything from scratch.

At its core, Uniswap on X Layer means that the Uniswap trading and liquidity experience is now available on a network associated with OKX that is positioned for lower-cost, faster transactions. For users, the benefit is straightforward: more affordable on-chain swaps, plus a smoother path to participating in liquidity pools and DeFi applications. For builders, the meaning is equally important: they can integrate swapping and routing logic in ways that bring volume and activity into the ecosystem, accelerating the network effects that turn a new deployment into a thriving market.

A successful deployment isn’t judged by marketing language. It’s judged by day-to-day behavior: how often users trade, how quickly liquidity deepens, whether prices remain competitive, and how easily external applications can connect. Uniswap on X Layer is relevant because it is meant to reduce the friction that prevents those behaviors from forming in the first place.

Why Multi-Surface Access Changes Adoption

DeFi liquidity is not only about having smart contracts live on a chain. It’s also about distribution: how many paths exist for users to reach those contracts. When Uniswap on X Layer is accessible through familiar user journeys, more people try it, and more trades flow through it. That flow encourages arbitrage, tightens spreads, and improves the quality of pricing across pairs. Over time, this supports the larger goal: cost-efficient DeFi access that doesn’t feel like a compromise.

Just as importantly, multi-surface access makes the environment more resilient. If one interface is less popular in a region or among a certain user segment, other entry points still bring volume. In DeFi, volume and liquidity are mutually reinforcing. The easier it is to reach the pools, the easier it is for pools to become deep enough to attract even more volume.

The Role of OKX’s Ecosystem in Driving Early Momentum

X Layer is closely tied to OKX’s broader push to bring more users on-chain. Large exchange ecosystems can be powerful distribution channels, especially when they focus attention on a specific network stack. That doesn’t guarantee success, but it increases the odds that a new DeFi venue can reach critical mass. In practical terms, Uniswap on X Layer benefits from being introduced into an environment where there is already a large pool of potential users who may want to explore DeFi with reduced costs.

How Layer 2 Scaling Supports Cheaper Swaps

Layer 2 networks exist because Ethereum’s base layer is designed for security and decentralization, not cheap high-frequency trading. L2s aim to compress and batch activity so users pay less per action. For traders, this often shows up as low gas fees and faster confirmations. For DeFi, the benefit goes beyond cost: cheaper blockspace allows more experimentation, more arbitrage, and more complex strategies that would be uneconomical on a high-fee base layer.

With Uniswap on X Layer, the user experience can become more “normal.” Instead of asking whether a swap is worth the gas, users can focus on market decisions: price, timing, and risk. That psychological shift matters. DeFi grows when users stop feeling like every transaction is a major commitment.

Why ZK Technology Is Often Associated With Better UX

Many scaling strategies aim to reduce cost, but ZK-based approaches are often highlighted because they can offer strong security properties while improving throughput. For everyday users, the technical details matter less than the outcome: predictable performance, cheaper transactions, and the feeling that the network is responsive. When a network is responsive, DeFi feels less like a queue and more like a real marketplace.

As Uniswap on X Layer gains traction, these advantages become visible in how users behave. More frequent swaps create more reliable price discovery. More frequent position updates can improve liquidity alignment. And the combined effect is a DeFi environment that feels both affordable and liquid.

Deep Liquidity: The Real Measure of a “Good” DeFi Venue

It’s easy to advertise low fees. It’s harder to deliver consistently good execution. That’s why deep liquidity is the real measure of whether a new network deployment becomes a serious trading venue. Deep liquidity means traders can swap with minimal slippage, routes can remain competitive across pairs, and the market can absorb volume without sudden price distortions.

For Uniswap on X Layer, liquidity depth is the bridge between the promise of cheap transactions and the reality of strong execution. If liquidity is shallow, traders might enjoy low fees but lose more to price impact. If liquidity becomes deep, traders get the best of both: low fees and better pricing.

This matters even more for larger orders. Small swaps might tolerate a little slippage. Larger swaps cannot. When liquidity is deep, larger swaps become viable, and that attracts more sophisticated traders and strategies. Sophisticated flow improves efficiency, and efficiency attracts even more flow. That’s how a deployment transitions from “available” to “important.”

How Uniswap’s AMM Structure Contributes to Market Quality

Uniswap is built around automated market maker (AMM) mechanics rather than a traditional order book. That design has advantages: it can be permissionless, composable, and available for any token pair as long as liquidity exists. But AMM performance depends heavily on liquidity distribution and market participation.

On a lower-fee network, AMM markets can become more efficient because arbitrageurs and market makers can rebalance more frequently. This tends to tighten prices relative to broader markets. Over time, the market behaves more like a well-functioning venue: spreads tighten, volatility is absorbed more smoothly, and users feel confident that they’re getting fair execution.

This is why Uniswap on X Layer is not only about saving money on fees. It’s about enabling the behaviors that produce market quality.

Why Concentrated Liquidity Can Shine in Low-Fee Environments

If users engage with Uniswap v3 mechanics and concentrated liquidity strategies, transaction costs matter even more. Concentrated liquidity can improve capital efficiency, but it often requires more active management. A lower-fee setting makes that management more realistic. When LPs can adjust positions without paying painful costs, ranges stay more aligned with the market price, and liquidity around the current price can become deeper.

In other words, Uniswap on X Layer can help turn liquidity provision from a “set it and forget it” gamble into a more strategic process, where LPs can respond to market shifts. The result, ideally, is better liquidity depth where it matters most: near the active trading price.

The User Experience: What Traders Gain From Uniswap on X Layer

For traders, the daily experience of DeFi comes down to three practical questions: What will this cost? How fast will it confirm? And what price will I actually get? Uniswap on X Layer targets all three by pairing a lower-fee environment with a well-known swapping engine and liquidity model.

Cost matters because it changes behavior. When fees are high, traders hesitate. When fees are low, traders trade. That increases overall volume, and volume improves price discovery and liquidity incentives. This is why cost-efficient DeFi access can become a self-fulfilling advantage: it unlocks activity that improves the market itself.

Lower Fees and More Frequent Strategy Adjustments

In a higher-fee environment, many users avoid making multiple small moves. They wait, consolidate, and transact less often. In a lower-fee environment, users can act in smaller increments. That can mean gradual position building, more frequent profit-taking, or routine rebalancing across assets. Over time, these behaviors create a healthier market: more consistent flow, more arbitrage, and fewer sudden liquidity gaps.

Better Execution as Liquidity Deepens

Execution quality is not static. It improves as liquidity deepens, routes become more competitive, and market makers engage more frequently. This is why the phrase deep liquidity is crucial when discussing Uniswap on X Layer. Lower fees attract early activity, early activity attracts liquidity, and liquidity improves execution. That’s how the ecosystem can transition from “new” to “credible.”

The LP Perspective: Why Liquidity Providers May Find X Layer Attractive

Liquidity provision is a trade-off between reward and risk. Rewards come from fees and, sometimes, incentives. Risks come from price volatility, impermanent loss, smart contract exposure, and opportunity cost. Fees are only attractive if the cost of managing the position doesn’t destroy profitability.

That’s where Uniswap on X Layer can become compelling for LPs. If it’s cheaper to deposit, adjust, and withdraw, the total strategy becomes more flexible. LPs can respond to changing market conditions rather than remaining stuck in suboptimal ranges because management is too expensive.

Active Management Becomes More Economical

One of the quiet benefits of cost-efficient DeFi access is that it makes active management strategies more realistic for smaller and mid-sized LPs. On a high-fee chain, only large positions can justify frequent updates. On a lower-fee chain, smaller positions can behave more like professionally managed positions because the fixed cost of action is reduced.

As LP participation increases, liquidity depth becomes more reliable. Reliable liquidity depth attracts more traders. More traders generate more fees. More fees attract more LPs. This is the loop that many networks aim to ignite, and Uniswap on X Layer gives that loop a strong starting point.

Why Liquidity Depth Protects LPs Too

Deep liquidity is not only good for traders. It can also improve the stability of a pool’s trading environment. When liquidity is shallow, trades can swing prices more violently, which can create chaotic fee patterns and unpredictable exposure. When liquidity becomes deep, price impact tends to be smoother, and the pool behaves more like a mature market.

For LPs using Uniswap on X Layer, that maturity is an important target. It can reduce the feeling that every market move is extreme, and it can improve the predictability of fee generation over time.

Developers and Builders: Why Uniswap on X Layer Matters for Integration

DeFi does not grow only through end users. It grows through integration. Wallets, aggregators, portfolio trackers, trading bots, and on-chain applications all depend on reliable swap infrastructure. When a major DEX is available on a new chain, builders can create new experiences more quickly because a core building block is already present.

Uniswap on X Layer supports this by enabling the ecosystem to route swaps and access liquidity in a more standardized way. When developers can depend on a known liquidity engine, they can focus on product design instead of reinventing trading infrastructure.

Composability and the Growth of On-Chain Apps

The power of DeFi comes from composability: protocols can plug into one another like money-legos. A DEX with deep liquidity becomes a foundational layer for lending, derivatives, yield strategies, and automated portfolio tools. As Uniswap on X Layer deepens, it can become a central routing venue for a growing set of applications.

Composability also improves user experience. Users want to do more than swap. They want to borrow against assets, earn yield, manage exposure, and automate strategies. Each of these experiences benefits from having reliable on-chain liquidity available at low cost.

Why One-Click UX Ambitions Matter

As the space matures, the main competition is increasingly user experience. The best protocols are those that reduce steps, reduce confusion, and reduce the number of wallet prompts required to do something simple. If the ecosystem can move toward smoother transaction flows, more users participate more often, and liquidity becomes deeper and more stable.

In that sense, Uniswap on X Layer isn’t only a market expansion—it’s part of a broader shift toward DeFi that feels less intimidating and more routine.

The Bigger Trend: Exchange-Linked L2s and DeFi’s Next Wave

Crypto cycles often repeat the same pattern: infrastructure improves, UX improves, and user participation expands. Exchange-linked ecosystems can accelerate that expansion because they already have distribution and brand recognition. At the same time, DeFi protocols like Uniswap benefit from being where users go next when they want to move from centralized trading into on-chain control.

Uniswap on X Layer sits at the intersection of these forces. It offers an on-chain venue that feels familiar to DeFi users while potentially being easier to discover for users coming from a large exchange ecosystem. If this blend succeeds, it could become a template for how DeFi adoption grows in the next phase: not through abstract promises, but through practical, low-cost, liquid experiences.

What to Watch as Adoption Unfolds

The health of Uniswap on X Layer will be visible in market signals rather than announcements. Watch liquidity depth across major pairs, consistency of swap execution, and whether the ecosystem attracts builders who create new reasons to use the chain. Watch whether users remain active after the initial novelty fades. Ultimately, a DeFi venue succeeds when it becomes part of a user’s routine, not just a one-time experiment.

Conclusion

The launch of Uniswap on X Layer of OKX is a meaningful step toward what DeFi users have been asking for: cost-efficient DeFi access without sacrificing execution quality. Lower transaction costs can remove the hesitation that keeps people from trading, experimenting, and managing positions. But the real value emerges as liquidity deepens, because deep liquidity transforms “cheap” into “good,” reducing slippage and strengthening price efficiency.

If these groups show up and stay active, the ecosystem can grow into a mature, liquid marketplace where low costs and strong execution reinforce each other.

FAQs

Q: What is the main benefit of Uniswap on X Layer for everyday users?

The biggest benefit of Uniswap on X Layer is cheaper on-chain interaction combined with a familiar swapping experience. Lower fees can make routine swaps, rebalancing, and DeFi exploration more practical for a wider range of users.

Q: Does lower gas automatically mean better trading results?

Not always. Low fees help, but execution quality depends on deep liquidity and competitive routing. As liquidity deepens on Uniswap on X Layer, users are more likely to see better pricing and less slippage alongside the cost savings.

Q: How can deep liquidity improve DeFi access?

Deep liquidity reduces slippage and price impact, especially for larger swaps. It also supports more reliable routing across token pairs, which makes the overall DeFi experience smoother and more consistent.

Q: Is Uniswap on X Layer suitable for liquidity providers?

It can be, especially for LPs who want to manage positions more actively. A lower-fee environment can make deposits, adjustments, and withdrawals less expensive, which improves the feasibility of strategies that require more frequent updates.

Q: Why does this launch matter for developers and DeFi builders?

A strong DEX deployment gives builders a core primitive they can integrate into wallets, dApps, and automated strategies. Uniswap on X Layer can act as a foundational liquidity source that helps new applications launch faster and offer better on-chain execution.

Also More: USD1 DeFi Lending Platform Launch Lifts Dolomite Tokens