USD1 DeFi Lending Platform Launch Lifts Dolomite Tokens

World Liberty Financial launches a USD1 DeFi lending platform powered by Dolomite. Learn how it works, why tokens jumped, and key risks.

World Liberty Financial launches DeFi lending platform for USD1, and the market reaction was immediate: Dolomite-linked tokens jumped as traders and DeFi users tried to price in what a new, branded lending venue could mean for liquidity, yields, and stablecoin adoption. In today’s crypto landscape, launching a lending product is not just about adding another app to the DeFi menu. It’s about building stablecoin utility, attracting on-chain liquidity, and creating a feedback loop where borrowing demand and lending supply reinforce one another. With USD1 positioned at the center, World Liberty Financial is signaling that it wants its stablecoin to be used, not merely held.

A stablecoin becomes more valuable when it is woven into the daily rails of DeFi: borrowing, lending, collateralized loans, and yield strategies that keep capital moving. That is why the phrase “World Liberty Financial launches DeFi lending platform” matters beyond headlines. It suggests an intent to compete where stablecoins compete hardest: inside money markets, where users decide which asset they trust enough to borrow, lend, and post as collateral in volatile conditions.

At the same time, the Dolomite connection adds another layer of significance. DeFi is built on composability—apps plugging into protocols, liquidity moving from one venue to another, and new front ends routing users through existing infrastructure. When World Liberty Financial launches DeFi lending platform features powered by Dolomite rails, the market often reads that as potential new volume, higher utilization, and more attention flowing toward Dolomite’s ecosystem. That narrative can drive a fast price move, which is a major reason Dolomite-linked tokens jumped.

In this deep dive, you’ll learn how a USD1-focused lending market typically works, what the Dolomite-powered design implies, why tokens reacted, and what risks users should understand before interacting with any DeFi lending platform—especially one that is new, rapidly growing, and under public scrutiny.

What the launch actually introduces to the DeFi market

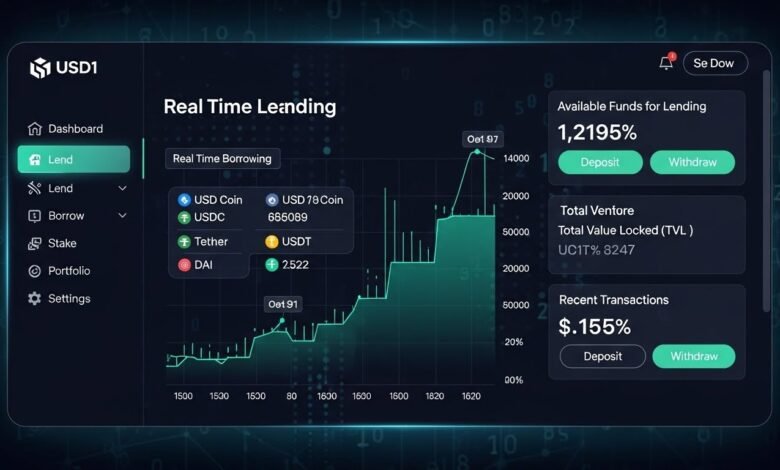

World Liberty Financial launches DeFi lending platform access for users who want to put USD1 to work through on-chain money markets. In practical terms, the platform enables two primary actions: supplying assets to earn variable interest and borrowing assets by posting collateral. The star of the experience is USD1, which is framed as both a productive asset for lenders and a liquid unit for borrowers who want stable purchasing power without selling volatile holdings.

This type of launch matters because it changes the stablecoin’s role. A stablecoin used only for transfers is a convenience. A stablecoin used for lending and borrowing becomes infrastructure. Once USD1 is available inside a lending venue, it can become a base currency for DeFi strategies: borrowing USD1 to deploy elsewhere, lending USD1 to earn yield, and using USD1 as a stable settlement asset between trades.

The market also tends to reward anything that appears to increase the “surface area” of a protocol or stablecoin. If the app successfully onboards new users, it could boost demand for USD1 and deepen liquidity in pools where USD1 is paired with other assets. If it succeeds in routing activity through Dolomite’s underlying markets, it can create a perception that Dolomite is becoming a more important hub for DeFi money markets—another reason Dolomite-linked tokens jumped.

How it fits into the broader stablecoin race

Stablecoins compete on trust, liquidity depth, redemption reliability, and integration breadth. But the most underappreciated battleground is utility. World Liberty Financial launches DeFi lending platform features that push USD1 into a category where stablecoins become “sticky”: money markets.

If users borrow USD1 for leverage, hedging, or spending, they create consistent demand. If users lend USD1 for yield, they create consistent supply. When both happen at once, the market becomes self-sustaining—provided risk controls hold up during volatility. The takeaway is that this is not just a product launch; it’s a distribution strategy for USD1.

How a USD1 DeFi lending platform works in real terms

The basic mechanics of DeFi money markets

A USD1 DeFi lending platform typically functions as a pool-based lending system governed by smart contracts. Lenders deposit assets—such as USD1 or other supported tokens—into liquidity pools. Borrowers draw from those pools by depositing collateral worth more than the borrowed amount. Interest rates are usually variable and respond to utilization: as more people borrow from a pool, the borrow rate increases, which tends to attract additional lenders seeking better yield.

When World Liberty Financial launches DeFi lending platform functionality, it effectively offers a user-friendly interface into this cycle. Lenders can supply USD1 to earn interest, and borrowers can borrow USD1 against collateral, gaining liquidity without selling their underlying assets. This “borrow without selling” value proposition is one of the main reasons DeFi lending exists at all.

Collateral, health factors, and liquidation logic

Every DeFi lending market lives and dies by its collateral rules. Borrowers maintain a health factor (or equivalent risk metric) that reflects how close they are to liquidation. If collateral value falls or borrowed value rises relative to collateral, the position can be liquidated to protect lenders.

Because crypto can move quickly, liquidation is not a rare event—it is a built-in feature. Any USD1 DeFi lending platform must balance attractive borrowing power with conservative safeguards. Too aggressive, and liquidations spike during volatility; too conservative, and borrowers go elsewhere.

World Liberty Financial launches DeFi lending platform markets that will likely be judged by how they behave when prices swing. In calm markets, everything looks smooth. In fast drawdowns, liquidation engines and oracle updates become the real test.

Interest rate dynamics and why users care

Users don’t just care about “APR.” They care about whether the rates are sustainable. In DeFi, “high yield” often signals either high demand for borrowing or short-term incentives designed to bootstrap liquidity. If USD1 supply grows rapidly, yields may compress unless borrow demand grows as well. If borrow demand spikes, borrowing rates may become expensive, potentially reducing usage.

A strong lending venue makes rates feel fair: lenders get rewarded when demand is high, borrowers pay a premium when capital is scarce, and the market equilibrates. If World Liberty Financial launches DeFi lending platform features that achieve that balance, USD1 could become a consistent player in DeFi money markets.

Why Dolomite-linked tokens jumped after the announcement

When World Liberty Financial launches DeFi lending platform infrastructure tied to Dolomite, markets often interpret it as a catalyst. The reaction—Dolomite-linked tokens jumped—can be explained by three overlapping forces: expected new flow, narrative momentum, and speculation on future integrations.

The “new flow” thesis: volume, fees, and attention

Crypto markets love measurable catalysts. A new app that routes users into an existing money market can lead to increased deposits, higher utilization, and more total value supplied or borrowed. Even before on-chain metrics confirm it, traders often front-run the possibility.

If a surge of users supplies assets or borrows USD1 through Dolomite-powered pools, the underlying ecosystem can see more usage. That potential alone can be enough for a rapid repricing, which is a straightforward reason Dolomite-linked tokens jumped.

Narrative momentum and the power of branding

DeFi is still intimidating to many users. A branded interface can bring in users who would never touch a raw protocol dashboard. When World Liberty Financial launches DeFi lending platform access under a recognizable name, it can lower the perceived barrier to entry. The market may interpret that as an onboarding funnel that grows user counts and liquidity.

Tokens react not only to what is happening today, but what could happen if adoption accelerates. That “could” is where narrative-driven volatility lives.

Speculation versus durable adoption

A token spike is not the same as a sustainable trend. Durable adoption requires repeat usage, competitive rates, and a reputation for stability through turbulence. If the platform’s early usage is driven by incentives alone, liquidity can leave when rewards fade. If it’s driven by genuine utility—borrowers wanting USD1 and lenders trusting USD1—usage can persist.

So, yes, Dolomite-linked tokens jumped, but the more important question is whether the activity that caused the jump stays.

What this launch could mean for USD1 adoption

World Liberty Financial launches DeFi lending platform markets that turn USD1 into a tool, not just a token. That shift can accelerate adoption in several ways.

USD1 as a borrow currency

In DeFi, the “borrow currency” is often the stablecoin. Users borrow stablecoins to deploy into other strategies, to trade, or to meet liquidity needs while holding volatile collateral. If USD1 becomes a preferred borrow currency, demand becomes structural rather than promotional.

Borrow demand can also increase USD1’s visibility. Each borrower becomes an ambassador in a way, because they are moving USD1 through DeFi apps, exchanges, and wallets.

USD1 as a lend-and-earn asset

Lenders want safety and liquidity, but they also want yield. If USD1 supply markets offer competitive rates, lenders may park capital there. Over time, this can build deeper USD1 liquidity and reduce volatility around peg stability because larger, more diverse pools tend to absorb shocks better.

A stablecoin that is widely supplied in lending markets becomes a baseline building block for DeFi.

USD1 as collateral—opportunity and caution

Some lending systems allow stablecoins to be used as collateral, which can be attractive for conservative users. However, stablecoin collateral also introduces its own risks: if confidence in the stablecoin wavers, collateral value assumptions can change quickly. Whether USD1 is accepted as collateral and under what parameters will matter for long-term trust.

The role of Dolomite in the platform’s design

World Liberty Financial launches DeFi lending platform access “powered by” an established protocol framework, which changes the risk and speed profile of the rollout.

Why building on existing rails can be an advantage

Using existing infrastructure can accelerate time-to-market and leverage battle-tested mechanisms for interest rates, collateral, and liquidations. In DeFi, security and reliability are everything. A new team writing new money-market contracts from scratch introduces additional uncertainty. Building atop known rails can reduce that uncertainty—though it doesn’t remove it entirely.

Composability and ecosystem spillovers

When apps are composable, liquidity and user activity can spill over. Users might borrow USD1 and deploy it into other DeFi venues, or they might bring assets from other ecosystems into the lending market. That creates secondary demand: swaps, bridges, liquidity pools, and hedging tools that support the lending activity.

This is another reason Dolomite-linked tokens jumped: the market may be pricing in not just a single app, but a broader chain reaction of integrations and usage.

Key risks users should understand before using any DeFi lending platform

World Liberty Financial launches DeFi lending platform markets that may feel simple, but the underlying risks are real. Understanding them is essential before supplying or borrowing.

Smart contract risk and integration risk

Smart contracts can have vulnerabilities. Even with audits, risk is never zero. Integration risk also matters: oracles, liquidity routing, and third-party dependencies can fail in unexpected ways.

Users should treat every DeFi interaction as a trade-off between convenience and risk. The smoother the front end, the easier it is to forget that you’re interacting with autonomous contracts.

Liquidation risk and fast markets

Borrowing can be powerful, but it magnifies risk. A sudden price drop can trigger liquidations. Even if the collateral rebounds later, liquidation is often irreversible. Users who borrow USD1 against volatile collateral should consider conservative positions and understand how health factors behave.

Stablecoin confidence risk

Stablecoins rely on market confidence. If users ever doubt backing, redemption, or operational integrity, liquidity can dry up and prices can deviate from peg. Even short-lived depegs can cause liquidations if stablecoins are used as borrow assets, settlement assets, or collateral.

This doesn’t mean USD1 is unsafe; it means stablecoins are systemic assets and deserve systemic caution.

Incentive risk and mercenary liquidity

If early liquidity is driven heavily by rewards, capital may leave as soon as incentives decline. That can reduce depth, raise rates, and make the market less attractive. Sustainable adoption comes from real usage: borrowers who want USD1 and lenders who trust the platform.

Competitive implications for DeFi lending

World Liberty Financial launches DeFi lending platform access into a crowded arena where incumbents already offer deep liquidity and broad collateral sets. To compete, a new lending venue typically needs at least one edge: a unique stablecoin distribution angle, a superior user experience, better incentives, or stronger partnerships.

User experience as a differentiator

Many DeFi platforms are functional but complex. A polished interface can win users who would otherwise stay on the sidelines. If the platform simplifies the steps for supplying USD1, borrowing USD1, monitoring risk, and managing collateral, it can create stickiness even if yields are similar elsewhere.

Liquidity depth and reliability as the long-term moat

In DeFi lending, depth matters. The deeper the liquidity, the more stable the rates, and the less likely users are to face slippage or abrupt spikes in borrowing costs. If World Liberty Financial launches DeFi lending platform markets that build durable USD1 depth, it can become a default venue for certain strategies.

Conclusion

World Liberty Financial launches DeFi lending platform features centered on USD1, and the immediate market response—Dolomite-linked tokens jumped—reflects how seriously DeFi markets take new liquidity pathways. A USD1 DeFi lending platform can turn a stablecoin into productive infrastructure, creating demand through borrowing and supply through yield. The Dolomite-powered design suggests an attempt to combine brand-driven distribution with established money-market rails.

Whether the launch becomes a lasting shift or a short-lived spike will depend on real adoption, competitive rates, and how the platform performs under stress. For users, the opportunity is clear—earn yield or unlock liquidity with USD1—but so are the risks: smart contract exposure, liquidation dynamics, and stablecoin confidence. In DeFi lending, the best outcomes go to those who understand both sides of that equation.

FAQs

Q: What is the USD1 DeFi lending platform launched by World Liberty Financial?

The USD1 DeFi lending platform is a borrowing and lending web app that lets users supply assets to earn interest and borrow assets—often USD1—by posting collateral through on-chain money market mechanics.

Q: Why did Dolomite-linked tokens jump after the launch?

Dolomite-linked tokens jumped because traders anticipated increased activity routed through Dolomite-powered lending rails, including new deposits, higher utilization, and broader attention from a branded user interface.

Q: Can I borrow USD1 without selling my crypto?

Yes. On a USD1 DeFi lending platform, you can typically borrow USD1 by depositing collateral like major crypto assets, allowing you to access liquidity while keeping exposure to your original holdings.

Q: What are the biggest risks when using a DeFi lending platform?

The biggest risks include smart contract vulnerabilities, liquidation during rapid price moves, oracle or integration failures, and stablecoin confidence shocks that can affect borrowing and collateral behavior.

Q: How can I use USD1 responsibly in DeFi lending?

Responsible use generally means supplying only what you can tolerate locking up, borrowing conservatively to reduce liquidation risk, monitoring your position regularly, and understanding how interest rates and collateral thresholds change with market conditions.

Aslo More: Top 3 DeFi Tokens to Keep an Eye on in 2026